What it means: COVID-19 Deferral of Employee FICA Tax

Por um escritor misterioso

Last updated 20 outubro 2024

On August 8, 2020, President Trump signed an Executive Order Deferring Employee FICA Taxes. We’ve put together a guide clarifying what the order means and who it applies to.

COVID-19 relief – Justworks Help Center

US] Deferral of employer payroll taxes – Help Center

CARES Act Allows Employers to Defer Employer Portion of Social Security Payroll Taxes - CPA Practice Advisor

IRS Defers Employee Payroll Taxes

Deferring Employee Social Security Taxes: Questions & Concerns

COVID-19: Social Security Payroll Tax Deferral Updates - Hawkins Ash CPAs

Navy Reserve - NAVADMIN 252/20 explains the temporary

Self-employed Social Security Tax Deferral

CARES Act Offers Social Security Tax Deferral and Tax Credit for Certain Employers Hurt by the

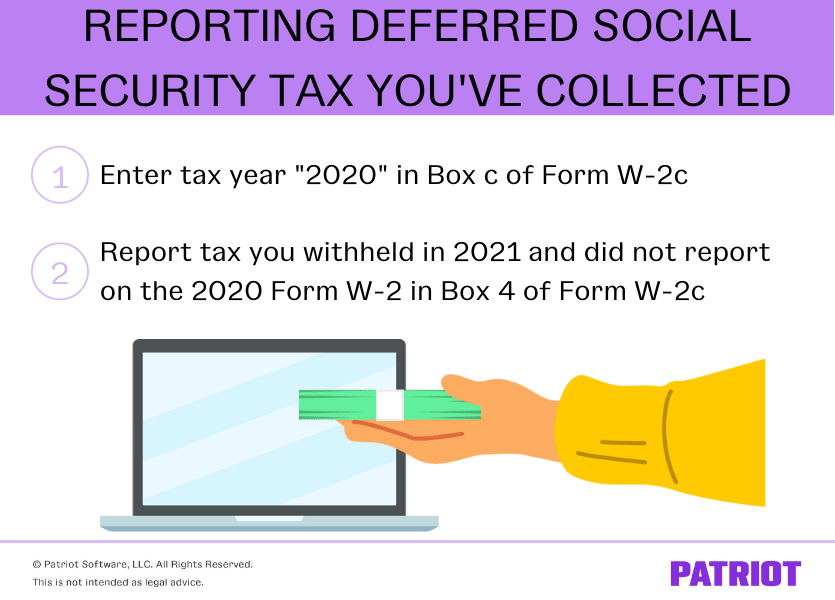

Reporting COVID Pay on W-2 2021

What does the executive action deferring payroll taxes mean for employers and employees? — Stonehenge Consulting, PLC

IRS Issues Guidance on COVID-19 Deferral of Social Security Tax

Recomendado para você

-

What is FICA Tax? - The TurboTax Blog20 outubro 2024

What is FICA Tax? - The TurboTax Blog20 outubro 2024 -

Important 2020 Federal Tax Deadlines for Small Businesses - Workest20 outubro 2024

Important 2020 Federal Tax Deadlines for Small Businesses - Workest20 outubro 2024 -

What is the FICA Tax and How Does it Connect to Social Security?20 outubro 2024

-

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)20 outubro 2024

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)20 outubro 2024 -

What are FICA Tax Payable? – SuperfastCPA CPA Review20 outubro 2024

What are FICA Tax Payable? – SuperfastCPA CPA Review20 outubro 2024 -

FICA Tax in 2022-2023: What Small Businesses Need to Know20 outubro 2024

FICA Tax in 2022-2023: What Small Businesses Need to Know20 outubro 2024 -

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax20 outubro 2024

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax20 outubro 2024 -

What Is FICA Tax? —20 outubro 2024

What Is FICA Tax? —20 outubro 2024 -

What Eliminating FICA Tax Means for Your Retirement20 outubro 2024

-

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com20 outubro 2024

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com20 outubro 2024

você pode gostar

-

linharez on X: Haganezuka kkk vc merece morrer Tanjirou. #DemonSlayerKimetsuNoYaiba #kimetsunoyaiba #Tanjirou #anime #mangá @matheusallblue / X20 outubro 2024

linharez on X: Haganezuka kkk vc merece morrer Tanjirou. #DemonSlayerKimetsuNoYaiba #kimetsunoyaiba #Tanjirou #anime #mangá @matheusallblue / X20 outubro 2024 -

Top 5 mods to turn Minecraft into a fantasy game20 outubro 2024

Top 5 mods to turn Minecraft into a fantasy game20 outubro 2024 -

Microsoft Flight Simulator: Standard Game of the Year Edition20 outubro 2024

Microsoft Flight Simulator: Standard Game of the Year Edition20 outubro 2024 -

ENGLISH :: Ultimate-custom-night-dicas20 outubro 2024

ENGLISH :: Ultimate-custom-night-dicas20 outubro 2024 -

Novo casal? Chloe Grace Moretz é fotografada aos beijos com modelo20 outubro 2024

Novo casal? Chloe Grace Moretz é fotografada aos beijos com modelo20 outubro 2024 -

Obtaining The RAREST Stands in Stands Awakening on Roblox20 outubro 2024

Obtaining The RAREST Stands in Stands Awakening on Roblox20 outubro 2024 -

Dragon Ball Xenoverse 2 - Deluxe Edition, PC20 outubro 2024

Dragon Ball Xenoverse 2 - Deluxe Edition, PC20 outubro 2024 -

Among Us (PC) - Steam Gift - GLOBAL - Cheap - G2A.COM!20 outubro 2024

Among Us (PC) - Steam Gift - GLOBAL - Cheap - G2A.COM!20 outubro 2024 -

Why You Need a Xbox 360 Right Now!20 outubro 2024

Why You Need a Xbox 360 Right Now!20 outubro 2024 -

Gakuen Mokushiroku: HIGHSCHOOL OF THE DEAD - Drifters of the Dead (High School of the Dead: Drifters of the Dead) · AniList20 outubro 2024

Gakuen Mokushiroku: HIGHSCHOOL OF THE DEAD - Drifters of the Dead (High School of the Dead: Drifters of the Dead) · AniList20 outubro 2024