What is FICA Tax? - The TurboTax Blog

Por um escritor misterioso

Last updated 02 abril 2025

Quick Answer: FICA is a payroll tax on earned income that covers a 6.2% Social Security tax and a 1.45% Medicare tax. If you’ve watched “Friends,” you can probably relate to Rachel opening her first paycheck and asking, “Who’s FICA? Why’s he getting all my money?” If you asked, you were probably told it was

Ways to File your Taxes with TurboTax For Free - The TurboTax Blog

Health Care Archives - The TurboTax Blog

Are Social Security Benefits Taxable? - The TurboTax Blog

How do I clear and start over in TurboTax Online? - TurboTax

Do Teens Have to File Taxes? - A Beginner's Guide for Teens

How Much are Medicare Deductions for the Self-Employed? - The

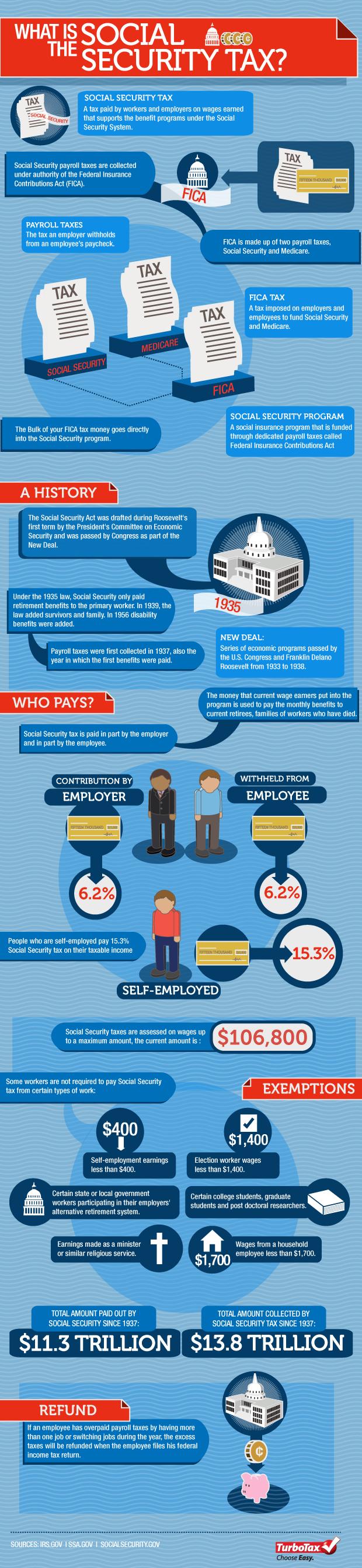

What is the Social Security Tax?

Do Creators Pay Taxes on Money Earned? - The TurboTax Blog

OPT Student Taxes Explained

TaxTouchdown - The TurboTax Blog

What is FICA Tax? - The TurboTax Blog

Overpaid Tax: Why It Matters to You - The TurboTax Blog

Recomendado para você

-

What Is FICA Tax? A Complete Guide for Small Businesses02 abril 2025

What Is FICA Tax? A Complete Guide for Small Businesses02 abril 2025 -

What are FICA Taxes? 2022-2023 Rates and Instructions02 abril 2025

-

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers02 abril 2025

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers02 abril 2025 -

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)02 abril 2025

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)02 abril 2025 -

Social Security Administration - “What is FICA on my paycheck?” Find out02 abril 2025

-

FICA Refund: How to claim it on your 1040 Tax Return?02 abril 2025

FICA Refund: How to claim it on your 1040 Tax Return?02 abril 2025 -

What is a payroll tax?, Payroll tax definition, types, and employer obligations02 abril 2025

What is a payroll tax?, Payroll tax definition, types, and employer obligations02 abril 2025 -

2021 FICA Tax Rates02 abril 2025

-

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books02 abril 2025

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books02 abril 2025 -

What Is FICA Tax, Understanding Payroll Tax Requirements02 abril 2025

What Is FICA Tax, Understanding Payroll Tax Requirements02 abril 2025

você pode gostar

-

Melhor jogo de panelas na Black Friday 2022: confira as principais apostas02 abril 2025

Melhor jogo de panelas na Black Friday 2022: confira as principais apostas02 abril 2025 -

LET'S GO! Como usá-lo corretamente? O Famoso VAMOS LÁ em inglês.02 abril 2025

LET'S GO! Como usá-lo corretamente? O Famoso VAMOS LÁ em inglês.02 abril 2025 -

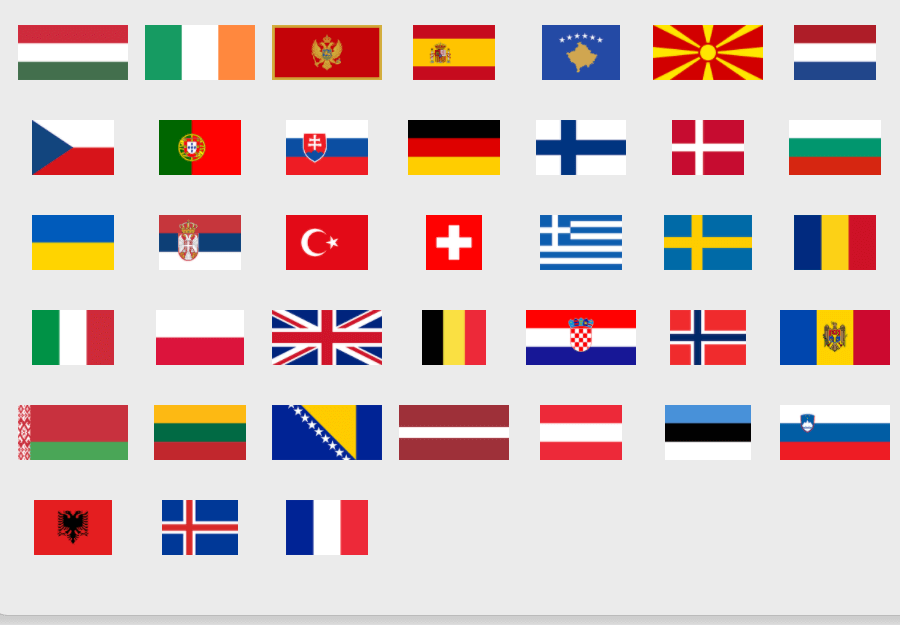

Europa: Bandeiras (versão fácil) - Flag Quiz Game - Seterra02 abril 2025

Europa: Bandeiras (versão fácil) - Flag Quiz Game - Seterra02 abril 2025 -

![Medusa Hub - [🔥UPDATE 8] Grand Piece Online](https://rscripts.net/images/64f32058b1e61_Midusa_avatar.png.webp) Medusa Hub - [🔥UPDATE 8] Grand Piece Online02 abril 2025

Medusa Hub - [🔥UPDATE 8] Grand Piece Online02 abril 2025 -

CapCut_ID De Roupas Mandrake No Brookhaven02 abril 2025

CapCut_ID De Roupas Mandrake No Brookhaven02 abril 2025 -

radagon and elden beast tips|TikTok Search02 abril 2025

-

Naruto team, anime, apple, iphone, kids, naruto shippuden, samsung02 abril 2025

Naruto team, anime, apple, iphone, kids, naruto shippuden, samsung02 abril 2025 -

Ironhide Game Studio - the 20th of November marked the 8th02 abril 2025

-

Kit Skate De Dedo 4 Peças Radical Material Reforçado Resistente Menino - dtoys - Skate de Dedo - Magazine Luiza02 abril 2025

Kit Skate De Dedo 4 Peças Radical Material Reforçado Resistente Menino - dtoys - Skate de Dedo - Magazine Luiza02 abril 2025 -

Hitori No Shita - The Outcast Lie - Watch on Crunchyroll02 abril 2025