2021 FICA Tax Rates

Por um escritor misterioso

Last updated 15 abril 2025

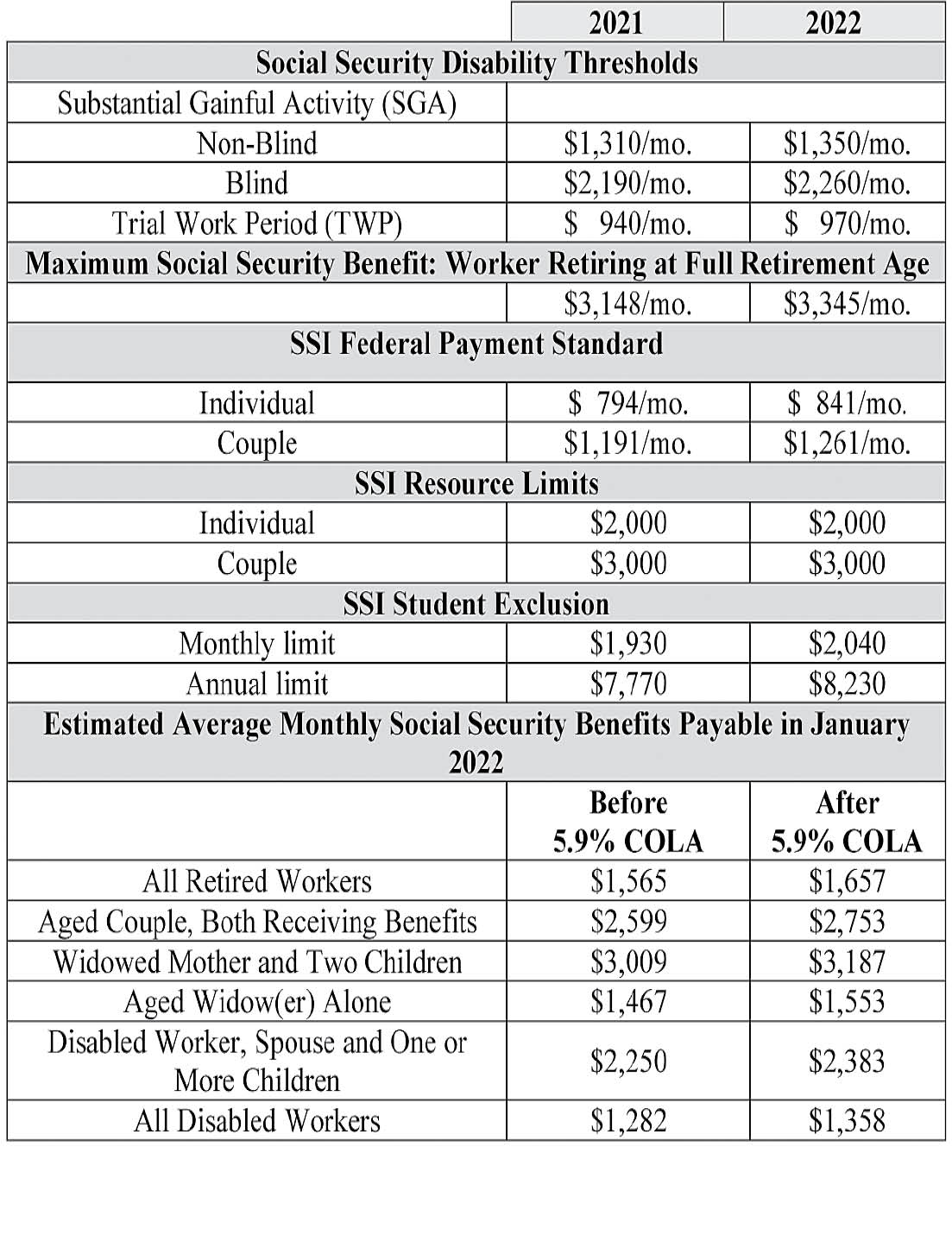

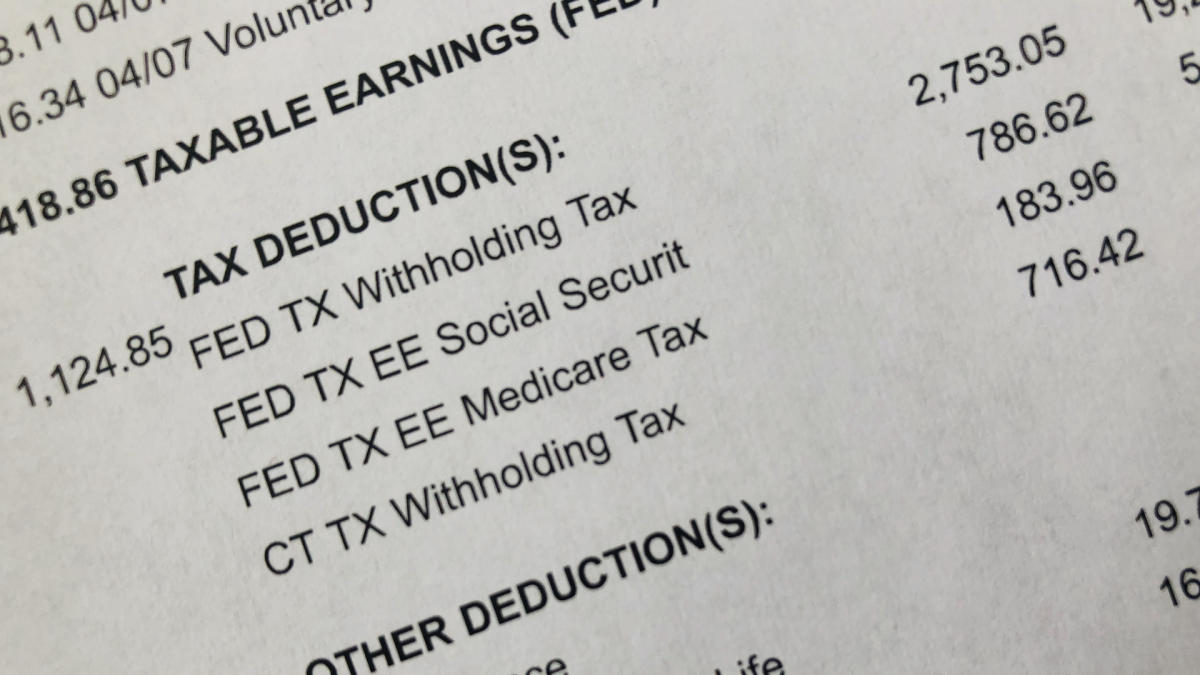

Social Security and Medicare income limits and tax rates FICA tax is a combination of a Social Security tax and a Medicare tax. The Social Security tax is assessed on wages up to $142,800 ($137,700 in 2020); the Medicare tax is assessed on all wages.

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax

What are the major federal payroll taxes, and how much money do they raise?

Medicare tax: Diving Deep into W2 Forms: Uncovering Medicare Taxes - FasterCapital

How Much Does an Employer Pay in Payroll Taxes?

YOUR SOCIAL SECURITY Davenport, Iowa Office

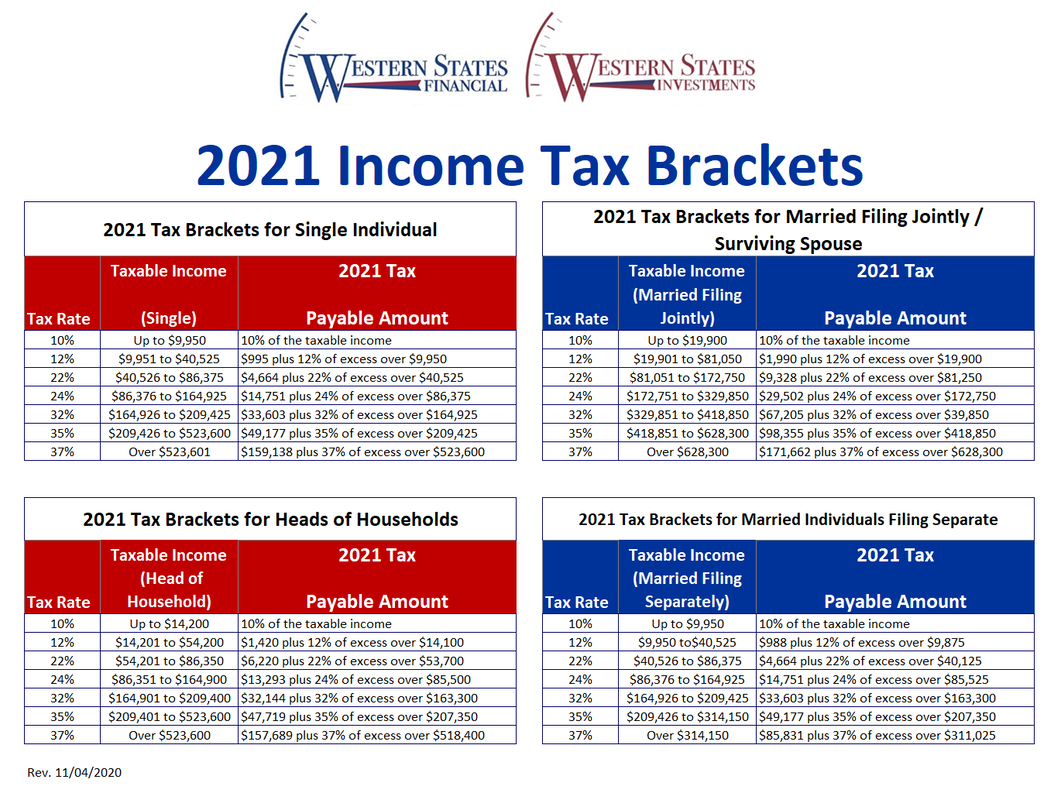

2021 Federal Tax Brackets, Tax Rates & Retirement Plans - Western States Financial & Western States Investments - Corona , CA John Weyhgandt, Financial Coach & Advisor

What is the FICA Tax and How Does it Connect to Social Security?

Maximize Your Paycheck: Understanding FICA Tax in 2024

Medicare Premiums and Tax Planning - Brownlee Wealth Management

2021 Wage Cap Rises for Social Security Payroll Taxes

FICA Tax: 4 Steps to Calculating FICA Tax in 2023

Recomendado para você

-

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png) Learn About FICA, Social Security, and Medicare Taxes15 abril 2025

Learn About FICA, Social Security, and Medicare Taxes15 abril 2025 -

What are FICA Taxes? 2022-2023 Rates and Instructions15 abril 2025

-

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks15 abril 2025

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks15 abril 2025 -

Family Finance Favs: Don't Leave Teens Wondering What The FICA?15 abril 2025

Family Finance Favs: Don't Leave Teens Wondering What The FICA?15 abril 2025 -

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes15 abril 2025

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes15 abril 2025 -

Overview of FICA Tax- Medicare & Social Security15 abril 2025

Overview of FICA Tax- Medicare & Social Security15 abril 2025 -

2023 FICA Tax Limits and Rates (How it Affects You)15 abril 2025

2023 FICA Tax Limits and Rates (How it Affects You)15 abril 2025 -

FICA Tax: Understanding Social Security and Medicare Taxes15 abril 2025

-

What are FICA Tax Payable? – SuperfastCPA CPA Review15 abril 2025

What are FICA Tax Payable? – SuperfastCPA CPA Review15 abril 2025 -

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet15 abril 2025

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet15 abril 2025

você pode gostar

-

Mashle Episode 1 Reveals Preview Images, Staff15 abril 2025

Mashle Episode 1 Reveals Preview Images, Staff15 abril 2025 -

285 Game Sound Effects Vol 0115 abril 2025

285 Game Sound Effects Vol 0115 abril 2025 -

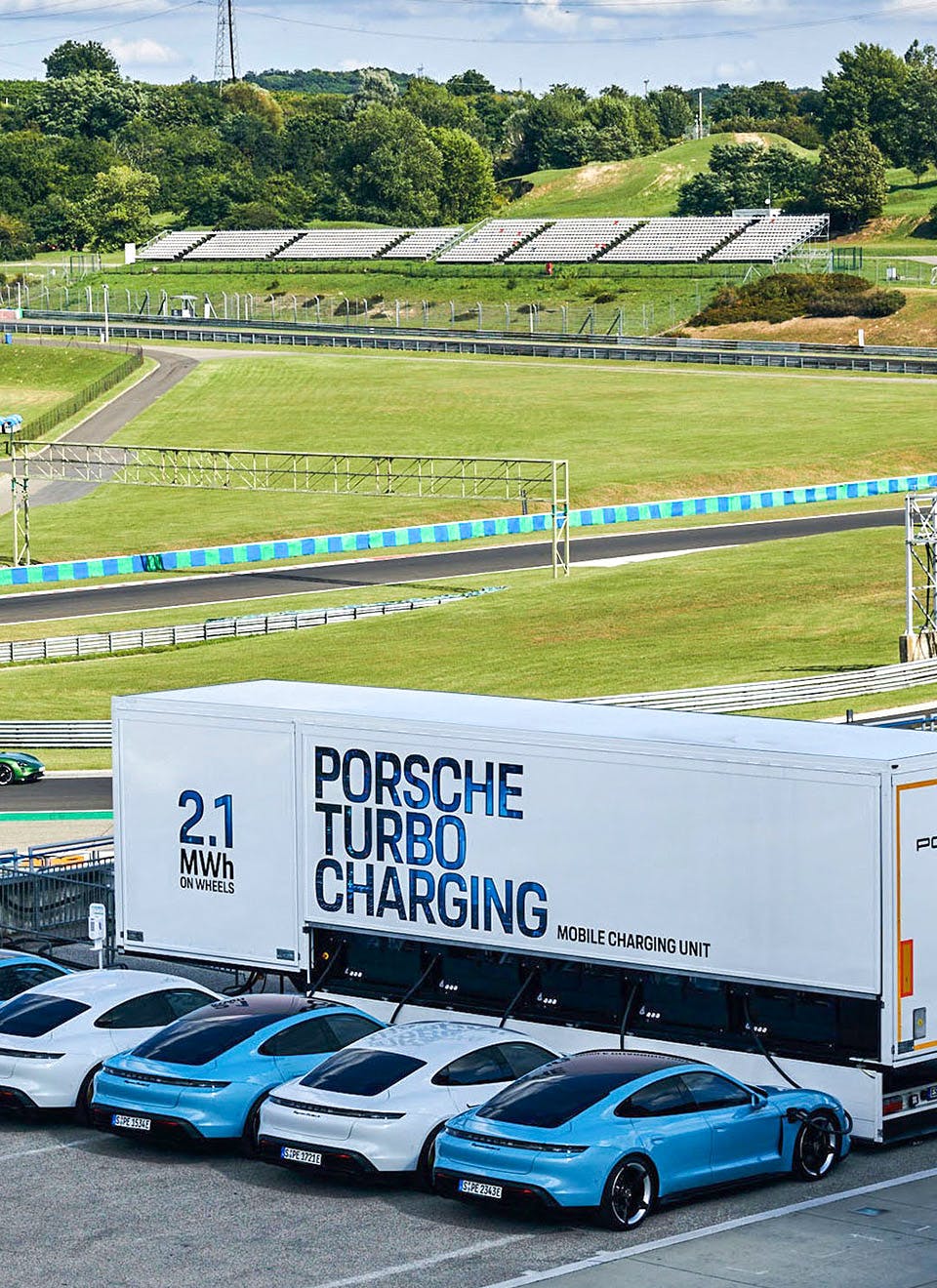

What is the Porsche Turbo Charging trailer?15 abril 2025

-

Cartamundi, shuffle, disney, princesas, baralho de cartas, 4 jogos em 1 deck, jogos: snap, famílias, casais e ação, multi idioma, crianças, família, amigos - AliExpress15 abril 2025

Cartamundi, shuffle, disney, princesas, baralho de cartas, 4 jogos em 1 deck, jogos: snap, famílias, casais e ação, multi idioma, crianças, família, amigos - AliExpress15 abril 2025 -

Pac-Man VS. terá modo Download Play no Switch via app - Nintendo Blast15 abril 2025

Pac-Man VS. terá modo Download Play no Switch via app - Nintendo Blast15 abril 2025 -

Who hurt me CHAPTER 402 SPOILER ALERT : r/MyHeroAcadamia15 abril 2025

Who hurt me CHAPTER 402 SPOILER ALERT : r/MyHeroAcadamia15 abril 2025 -

Knockout City on X: Block Party Bundle items are ONLY available15 abril 2025

Knockout City on X: Block Party Bundle items are ONLY available15 abril 2025 -

Jogadores exaltam dia histórico no primeiro jogo na Arena MRV – Clube Atlético Mineiro15 abril 2025

Jogadores exaltam dia histórico no primeiro jogo na Arena MRV – Clube Atlético Mineiro15 abril 2025 -

On Set for GTA: San Andreas Movie : r/midjourney15 abril 2025

On Set for GTA: San Andreas Movie : r/midjourney15 abril 2025 -

Dailynarutoimagines — Hi guys!May I ask, since there are so many15 abril 2025

Dailynarutoimagines — Hi guys!May I ask, since there are so many15 abril 2025