FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Por um escritor misterioso

Last updated 12 abril 2025

Employers and employees must pay FICA taxes to contribute to social security and medicare. What you need to know.

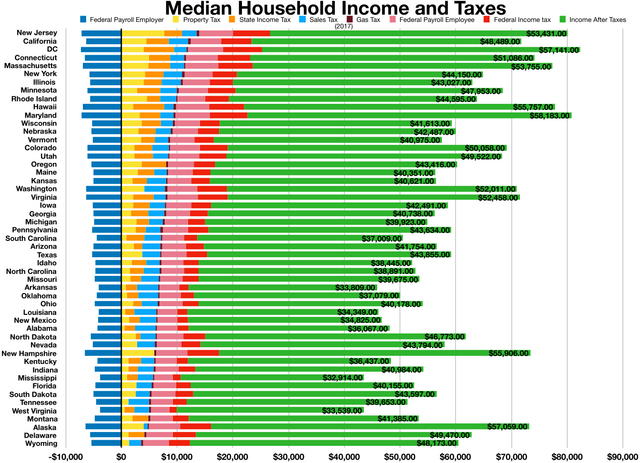

Paycheck Taxes - Federal, State & Local Withholding

20 Popular Tax Deductions and Tax Breaks for 2023-2024 - NerdWallet

Hiring a Remote Worker? It Takes More Than an Internet Connection - NerdWallet

Federal Insurance Contributions Act - Wikipedia

How Much Should I Pay My Employees? - NerdWallet

Self-Employment Tax: What It Is, How to Calculate It - NerdWallet

The ABCs of FICA: Federal Insurance Contributions Act Explained - FasterCapital

Restricted Stock Units: What You Need to Know About RSUs - NerdWallet

Tax relief for good deeds

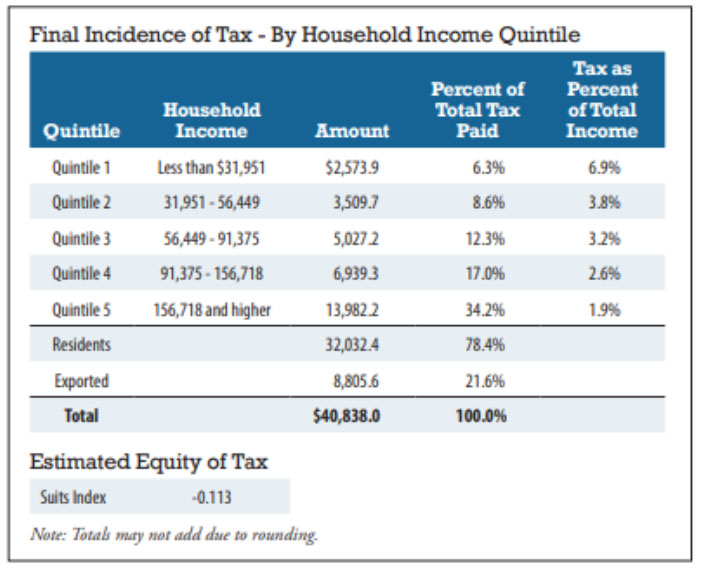

SUGGESTIONS FOR IMPROVING TAX COMPLIANCE THROUGH GREATER TAX SYSTEM TRANSPARENCY AND ACCOUNTABILITY - California Lawyers Association

Recomendado para você

-

What Is FICA Tax? A Complete Guide for Small Businesses12 abril 2025

What Is FICA Tax? A Complete Guide for Small Businesses12 abril 2025 -

What are FICA Taxes? 2022-2023 Rates and Instructions12 abril 2025

-

FICA Tax: 4 Steps to Calculating FICA Tax in 202312 abril 2025

FICA Tax: 4 Steps to Calculating FICA Tax in 202312 abril 2025 -

FICA Tax Exemption for Nonresident Aliens Explained12 abril 2025

FICA Tax Exemption for Nonresident Aliens Explained12 abril 2025 -

Employee Social Security Tax Deferral Repayment12 abril 2025

Employee Social Security Tax Deferral Repayment12 abril 2025 -

Solved 2016 FICA Tax Rates 1 1 FICA taxes include Social12 abril 2025

-

What is FICA tax? Are you struggling to understand what the FICA tax is and if you need to pay it as a small business owner? Check out this video, and12 abril 2025

-

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student12 abril 2025

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student12 abril 2025 -

2019 US Tax Season in Numbers for Sprintax Customers12 abril 2025

2019 US Tax Season in Numbers for Sprintax Customers12 abril 2025 -

FICA Tax Tip Fairness Pro Beauty Association12 abril 2025

FICA Tax Tip Fairness Pro Beauty Association12 abril 2025

você pode gostar

-

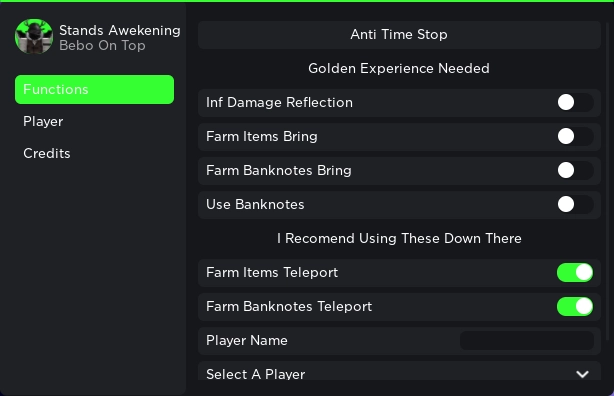

— New Stands Awakening GUI12 abril 2025

— New Stands Awakening GUI12 abril 2025 -

Radharani - A contraparte feminina de Krishna – Bazar Indiano12 abril 2025

Radharani - A contraparte feminina de Krishna – Bazar Indiano12 abril 2025 -

how to get hacks on agario on ios|TikTok Search12 abril 2025

-

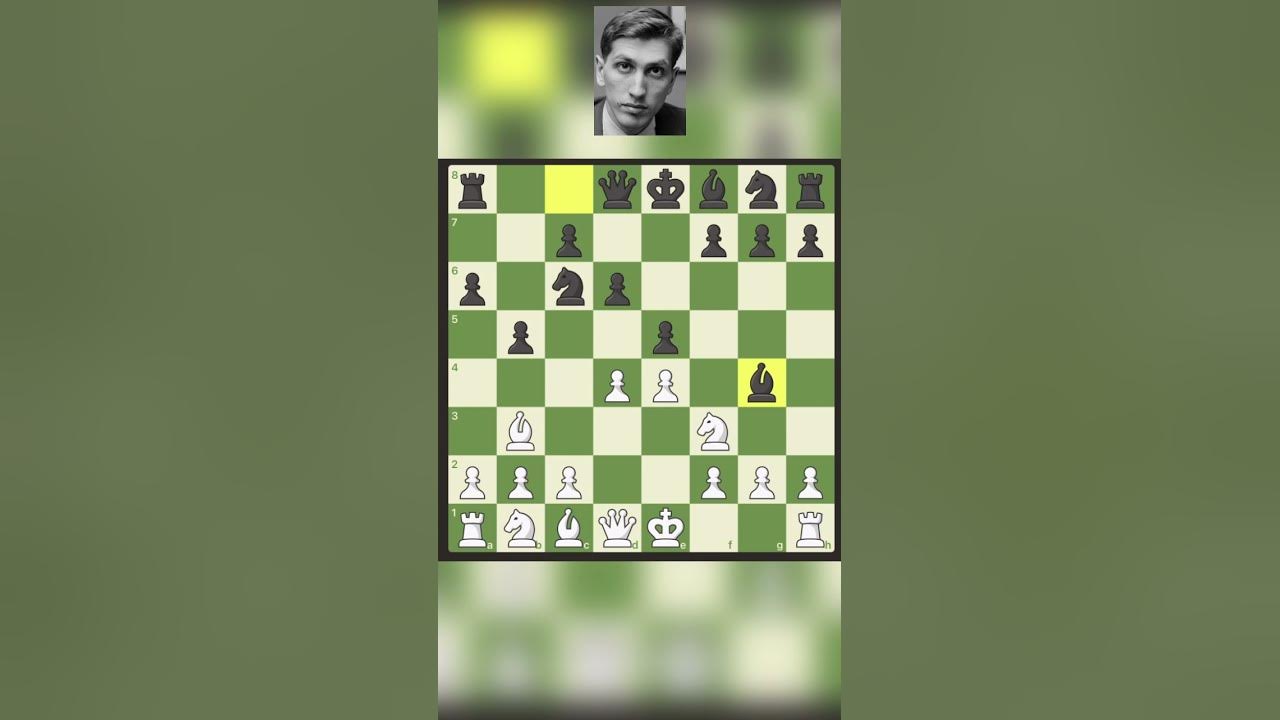

Ruy López Opening: Morphy Defense, Jacob Altusky Bobby Fischer 0-112 abril 2025

Ruy López Opening: Morphy Defense, Jacob Altusky Bobby Fischer 0-112 abril 2025 -

Bomb Party Ring Skinny Tumbler Small Business 20oz Skinny12 abril 2025

Bomb Party Ring Skinny Tumbler Small Business 20oz Skinny12 abril 2025 -

Low and Slow Smoked Tri Tip Recipe - Hey Grill, Hey12 abril 2025

Low and Slow Smoked Tri Tip Recipe - Hey Grill, Hey12 abril 2025 -

soft avatar roblox boy|TikTok Search12 abril 2025

soft avatar roblox boy|TikTok Search12 abril 2025 -

GitHub - moonstar-x/discord-free-games-notifier: A Discord bot12 abril 2025

-

Killing Stalking: Deluxe Edition Vol. 3|Paperback12 abril 2025

Killing Stalking: Deluxe Edition Vol. 3|Paperback12 abril 2025 -

Mondaiji Tachi12 abril 2025

Mondaiji Tachi12 abril 2025