FICA Tax in 2022-2023: What Small Businesses Need to Know

Por um escritor misterioso

Last updated 10 abril 2025

FICA taxes are paid by all workers. The FICA taxes are paid based on your total income from all sources. Here is what small businesses need to know.

2023 Tax Deadlines You Need to Know - Experian

FICA Tax in 2022-2023: What Small Businesses Need to Know

What are FICA Taxes? 2022-2023 Rates and Instructions

How Much Does A Small Business Pay In Taxes?

What are FICA Taxes? 2022-2023 Rates and Instructions

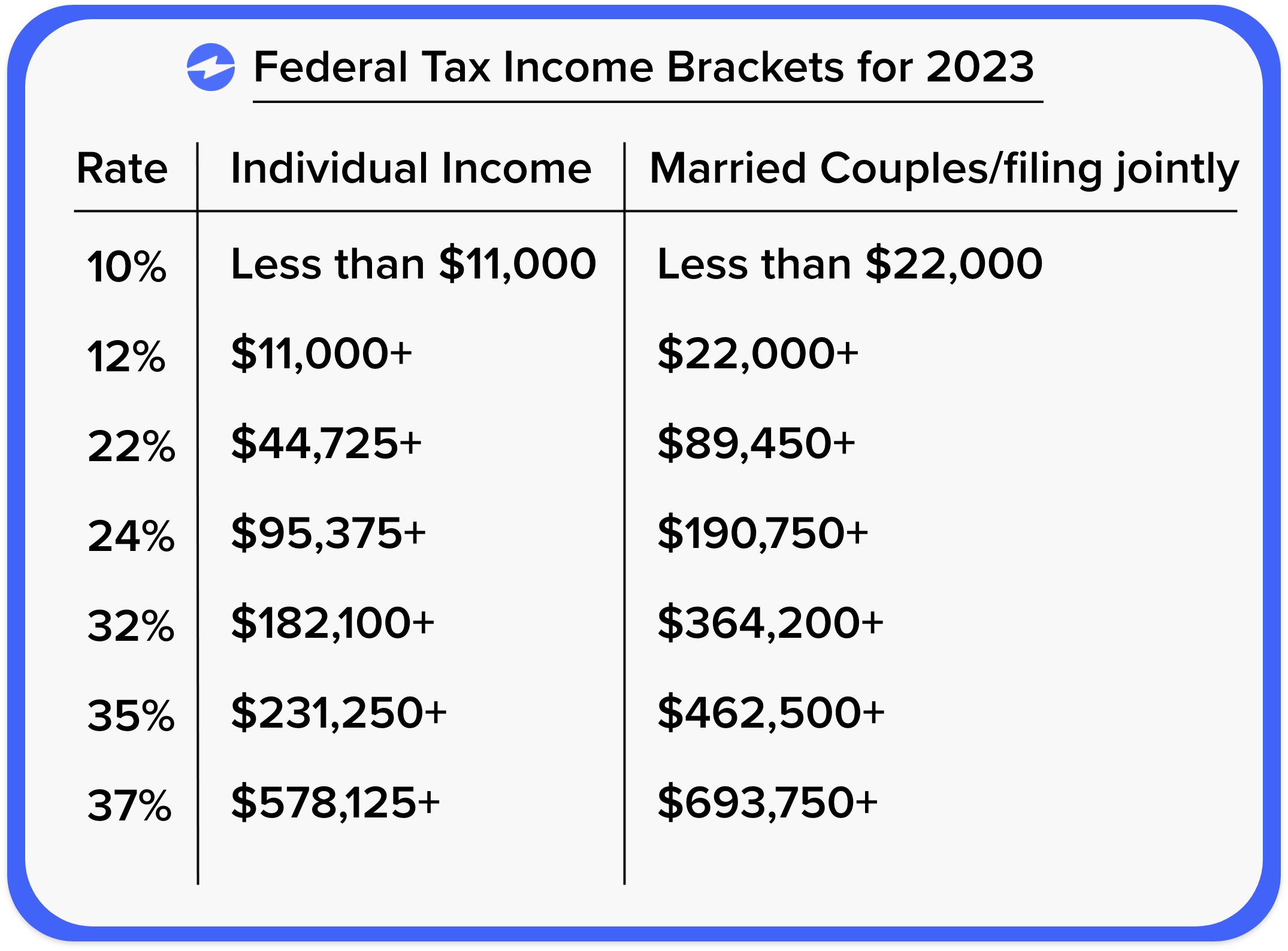

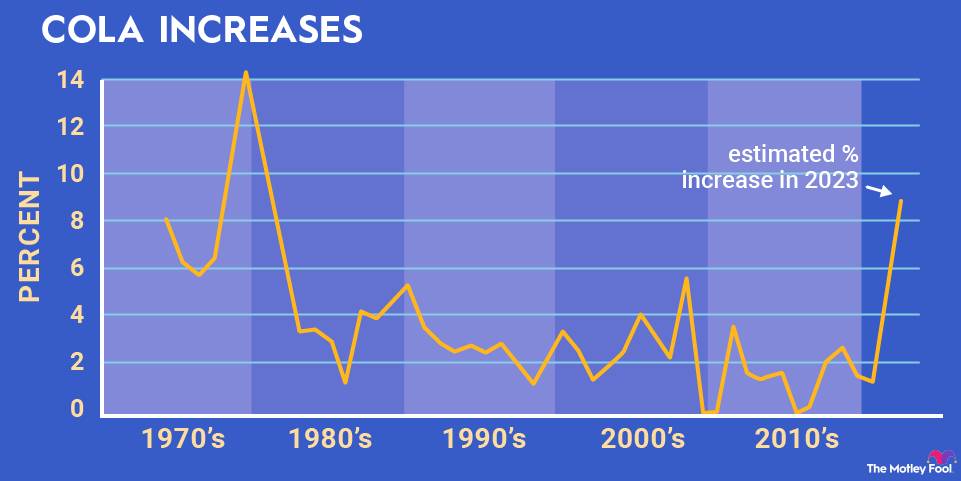

Social Security COLA for 2023

Payroll Tax Rates and Benefits Plan Limits for 2023 - Workest

IRS Tax Deadlines Calendar for 2023

Business Taxes: Annual v. Quarterly Filing for Small Businesses

Tax filing tips: What to know to help get biggest refund on 2022 taxes

2023 FICA Tax Limits and Rates (How it Affects You)

2023 IRS Form W-2: Simple Instructions + PDF Download

Social Security and Medicare Taxes in 2023: What's New and What's

FICA Tax in 2022-2023: What Small Businesses Need to Know

Recomendado para você

-

What is FICA10 abril 2025

What is FICA10 abril 2025 -

FICA Tax: 4 Steps to Calculating FICA Tax in 202310 abril 2025

FICA Tax: 4 Steps to Calculating FICA Tax in 202310 abril 2025 -

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)10 abril 2025

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)10 abril 2025 -

What are FICA Tax Payable? – SuperfastCPA CPA Review10 abril 2025

What are FICA Tax Payable? – SuperfastCPA CPA Review10 abril 2025 -

What Is FICA on a Paycheck? FICA Tax Explained - Chime10 abril 2025

What Is FICA on a Paycheck? FICA Tax Explained - Chime10 abril 2025 -

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax10 abril 2025

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax10 abril 2025 -

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.10 abril 2025

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.10 abril 2025 -

IRS Form 843 - Request a Refund of FICA Taxes10 abril 2025

IRS Form 843 - Request a Refund of FICA Taxes10 abril 2025 -

FICA Tax Tip Fairness Pro Beauty Association10 abril 2025

FICA Tax Tip Fairness Pro Beauty Association10 abril 2025 -

What is FICA and How To Calculate FICA Tax 2023 With Complete Guide?10 abril 2025

What is FICA and How To Calculate FICA Tax 2023 With Complete Guide?10 abril 2025

você pode gostar

-

Jogos de Swords And Sandals 2 no Jogos 36010 abril 2025

Jogos de Swords And Sandals 2 no Jogos 36010 abril 2025 -

Shindo Life War Mode Private Server Codes10 abril 2025

Shindo Life War Mode Private Server Codes10 abril 2025 -

MENU10 abril 2025

MENU10 abril 2025 -

Open English Junior Login10 abril 2025

Open English Junior Login10 abril 2025 -

Seguidores se despedem de Júlia Hennessy, influencer de BH morta10 abril 2025

Seguidores se despedem de Júlia Hennessy, influencer de BH morta10 abril 2025 -

Saihate no Paladin - Dublado - Paladin of the End, Ultimate Paladin, The Faraway Paladin - Animes Online10 abril 2025

Saihate no Paladin - Dublado - Paladin of the End, Ultimate Paladin, The Faraway Paladin - Animes Online10 abril 2025 -

Lance Reddick's wife Stephanie speaks out for the first time after10 abril 2025

Lance Reddick's wife Stephanie speaks out for the first time after10 abril 2025 -

3rd Dog Days Season Casts Sumire Uesaka as New Character - News - Anime News Network10 abril 2025

3rd Dog Days Season Casts Sumire Uesaka as New Character - News - Anime News Network10 abril 2025 -

Jogos com caneta e papel – Família de Trigo10 abril 2025

Jogos com caneta e papel – Família de Trigo10 abril 2025 -

Mumei10 abril 2025