What Is Social Security Tax? Definition, Exemptions, and Example

Por um escritor misterioso

Last updated 02 abril 2025

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

The Social Security tax, levied on both employers and employees, funds Social Security and is collected in the form of a payroll tax or a self-employment tax.

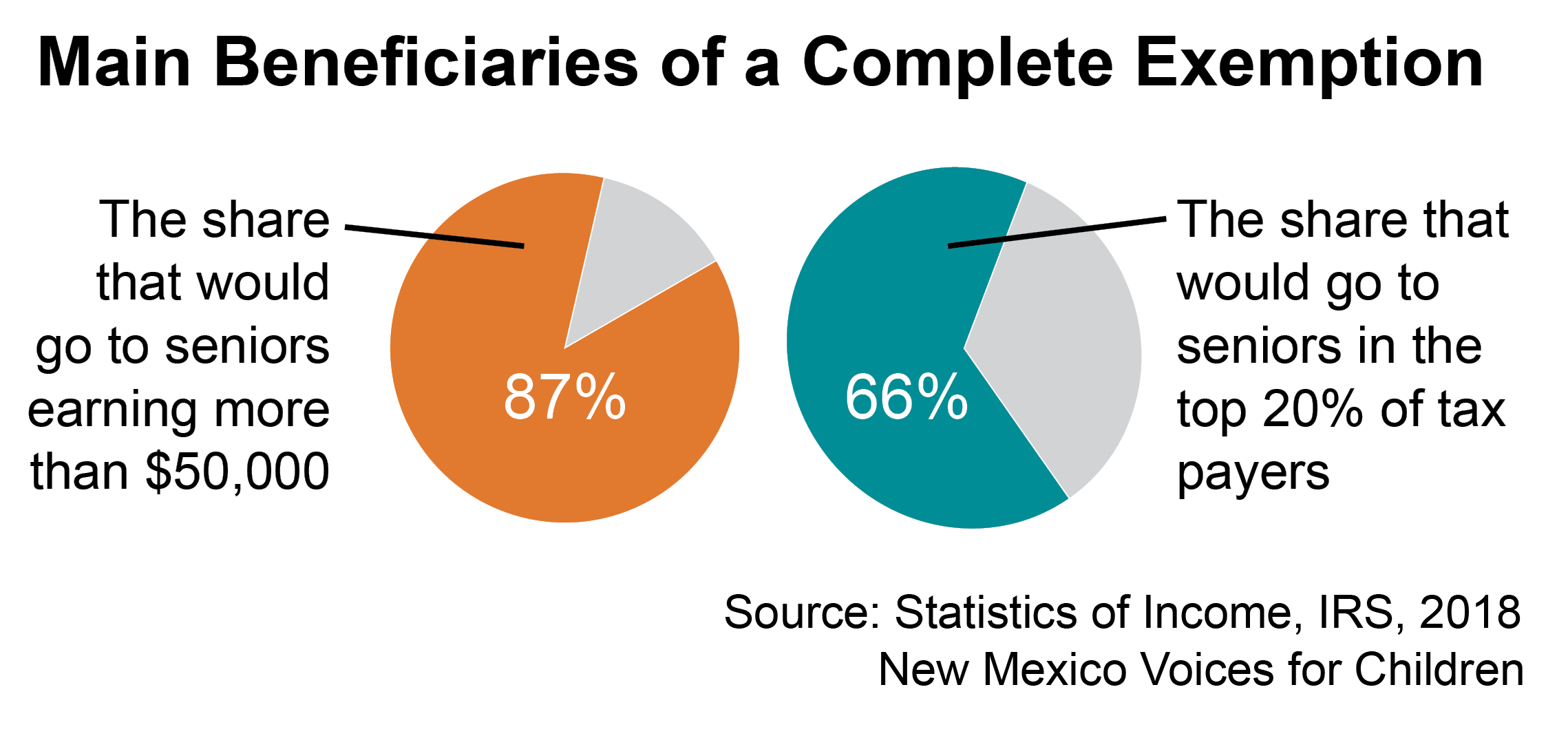

State Income Tax Subsidies for Seniors – ITEP

Understanding Your Tax Forms 2016: SSA-1099, Social Security Benefits

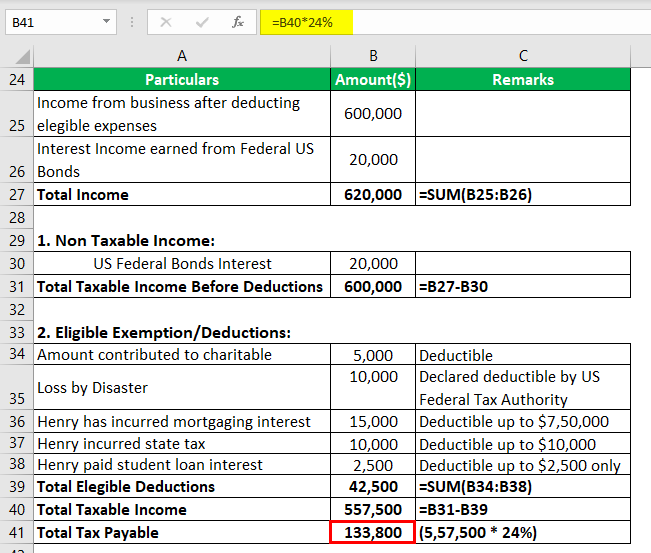

Tax Exempt - Meaning, Examples, Organizations, How it Works

What is Backup Withholding Tax

Research: Income Taxes on Social Security Benefits

Taxation in the United States - Wikipedia

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

What Is Social Security Tax? Definition, Exemptions, and Example

Exempting Social Security Income from Taxation: Not Targeted, Not Necessary, Not Cheap – New Mexico Voices for Children

7 Things to Know About Social Security and Taxes

The Evolution of Social Security's Taxable Maximum

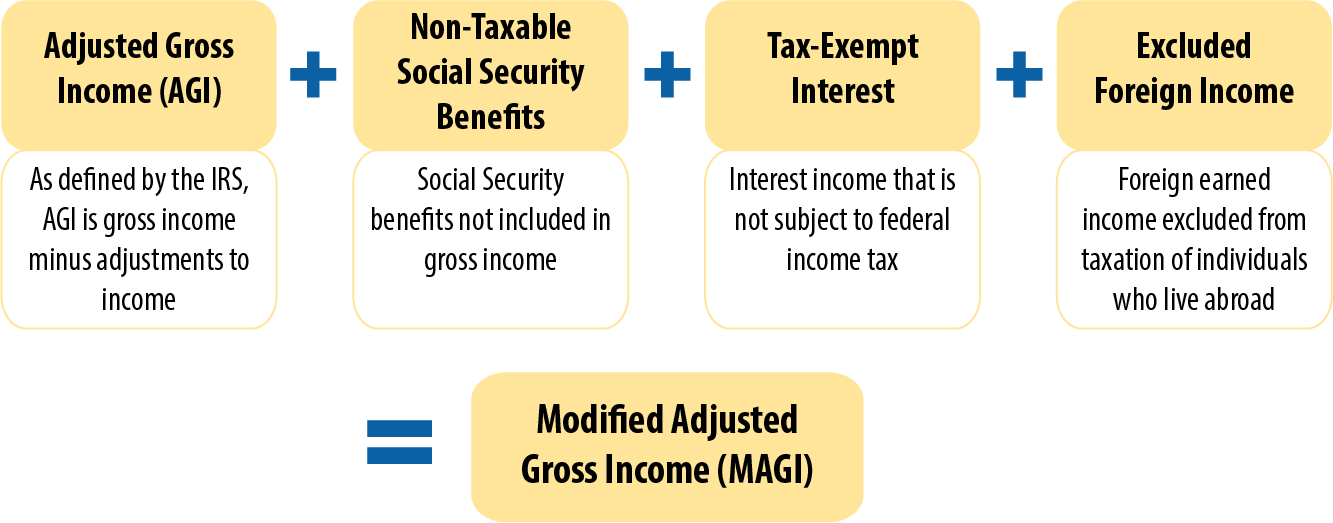

Income Definitions for Marketplace and Medicaid Coverage - Beyond the Basics

W-4: Guide to the 2023 Tax Withholding Form - NerdWallet

The Evolution of Social Security's Taxable Maximum

Recomendado para você

-

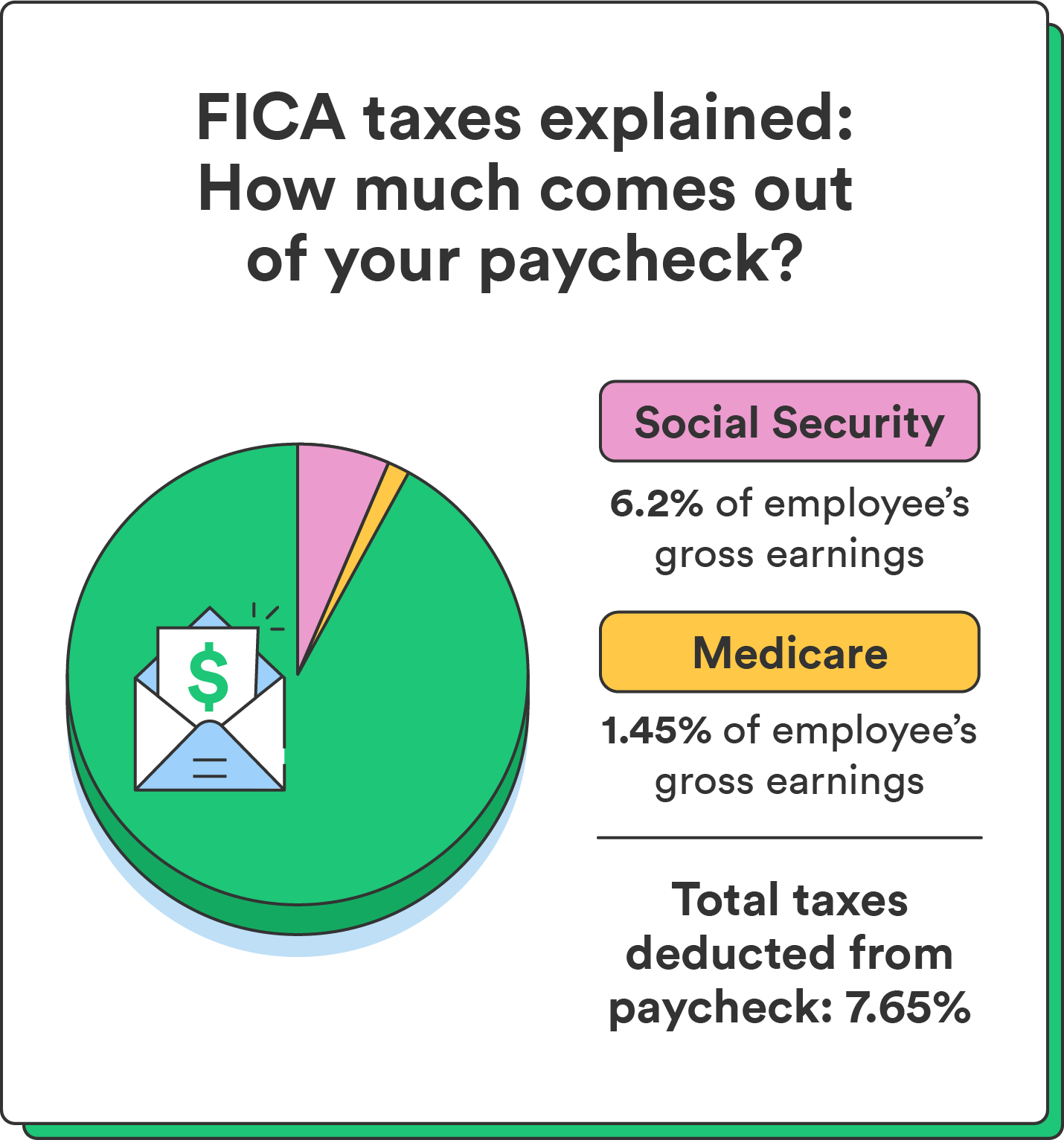

What is Fica Tax?, What is Fica on My Paycheck02 abril 2025

What is Fica Tax?, What is Fica on My Paycheck02 abril 2025 -

Important 2020 Federal Tax Deadlines for Small Businesses - Workest02 abril 2025

Important 2020 Federal Tax Deadlines for Small Businesses - Workest02 abril 2025 -

FICA Tax: Understanding Social Security and Medicare Taxes02 abril 2025

-

:max_bytes(150000):strip_icc()/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg) Why Is There a Cap on the FICA Tax?02 abril 2025

Why Is There a Cap on the FICA Tax?02 abril 2025 -

What Is FICA on a Paycheck? FICA Tax Explained - Chime02 abril 2025

What Is FICA on a Paycheck? FICA Tax Explained - Chime02 abril 2025 -

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax02 abril 2025

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax02 abril 2025 -

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student02 abril 2025

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student02 abril 2025 -

What it means: COVID-19 Deferral of Employee FICA Tax02 abril 2025

What it means: COVID-19 Deferral of Employee FICA Tax02 abril 2025 -

2017 FICA Tax: What You Need to Know02 abril 2025

2017 FICA Tax: What You Need to Know02 abril 2025 -

FAQs + What to do about NYU's faulty FICA taxes – GSOC-UAW Local 211002 abril 2025

FAQs + What to do about NYU's faulty FICA taxes – GSOC-UAW Local 211002 abril 2025

você pode gostar

-

Goobotech Lousa Digital02 abril 2025

Goobotech Lousa Digital02 abril 2025 -

Pikachu fanart papel de parede hd mais incrível e popular02 abril 2025

Pikachu fanart papel de parede hd mais incrível e popular02 abril 2025 -

Diagrams of Basketball Courts - Recreation Unlimited02 abril 2025

Diagrams of Basketball Courts - Recreation Unlimited02 abril 2025 -

:format(webp):quality(80)/wp-content/uploads/2022/03/universitatea-cluj-concordia-chiajna-liga-2-casa-pariurilor-28022022-scaled.jpg) Liga 2, etapa a 18-a. FC Hermannstadt - U Cluj 0-2. Băieții lui Erik Lincar se impun fără emoții și ajung pe locul secund din Liga 202 abril 2025

Liga 2, etapa a 18-a. FC Hermannstadt - U Cluj 0-2. Băieții lui Erik Lincar se impun fără emoții și ajung pe locul secund din Liga 202 abril 2025 -

Jogo Naruto Shippuden - Ultimate Ninja 5 Ps2 - Escorrega o Preço02 abril 2025

-

Reddit's Chief Says He Wants It to 'Grow Up.' Will Its Community02 abril 2025

Reddit's Chief Says He Wants It to 'Grow Up.' Will Its Community02 abril 2025 -

Watch Dua Lipa's 'Houdini' Music Video and Read Full Lyrics02 abril 2025

Watch Dua Lipa's 'Houdini' Music Video and Read Full Lyrics02 abril 2025 -

Steam Workshop::gmod02 abril 2025

-

2v2 Tier List02 abril 2025

2v2 Tier List02 abril 2025 -

Girasea #345.116 - FusionDex02 abril 2025

Girasea #345.116 - FusionDex02 abril 2025