ropay on X: Experience effortless tax calculations with roPay's reverse payroll feature! No more manual calculations or data entry stress. Simply input net salaries, and roPay will automatically determine allowances, pensions, and

Por um escritor misterioso

Last updated 12 abril 2025

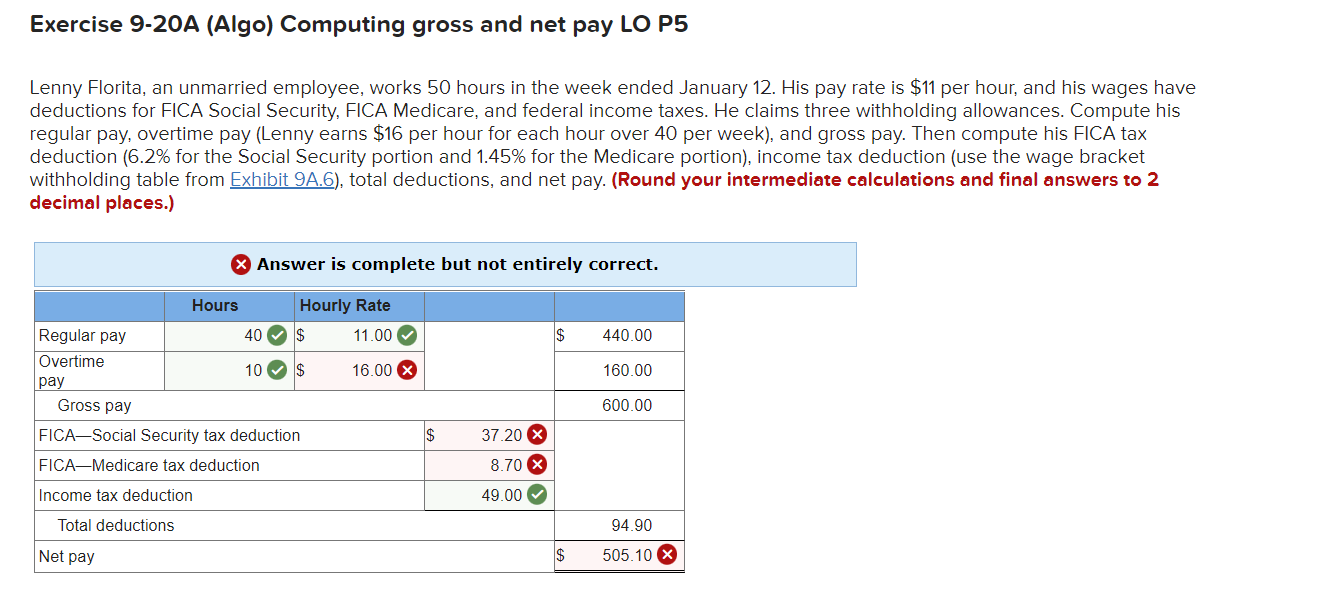

Solved Exercise 9-20A (Algo) Computing gross and net pay LO

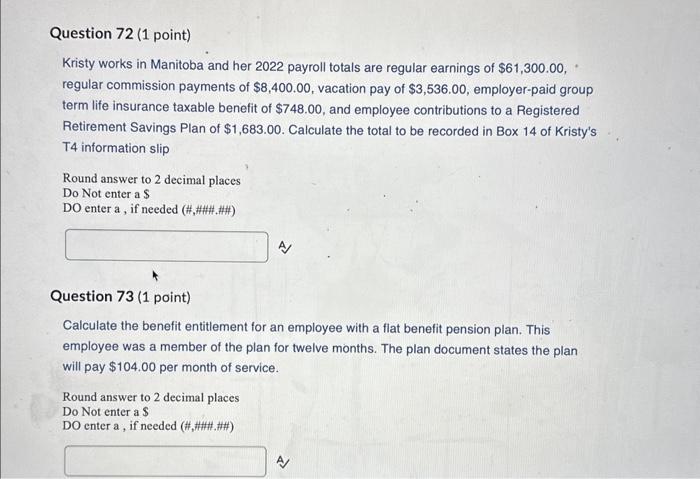

Solved Kristy works in Manitoba and her 2022 payroll totals

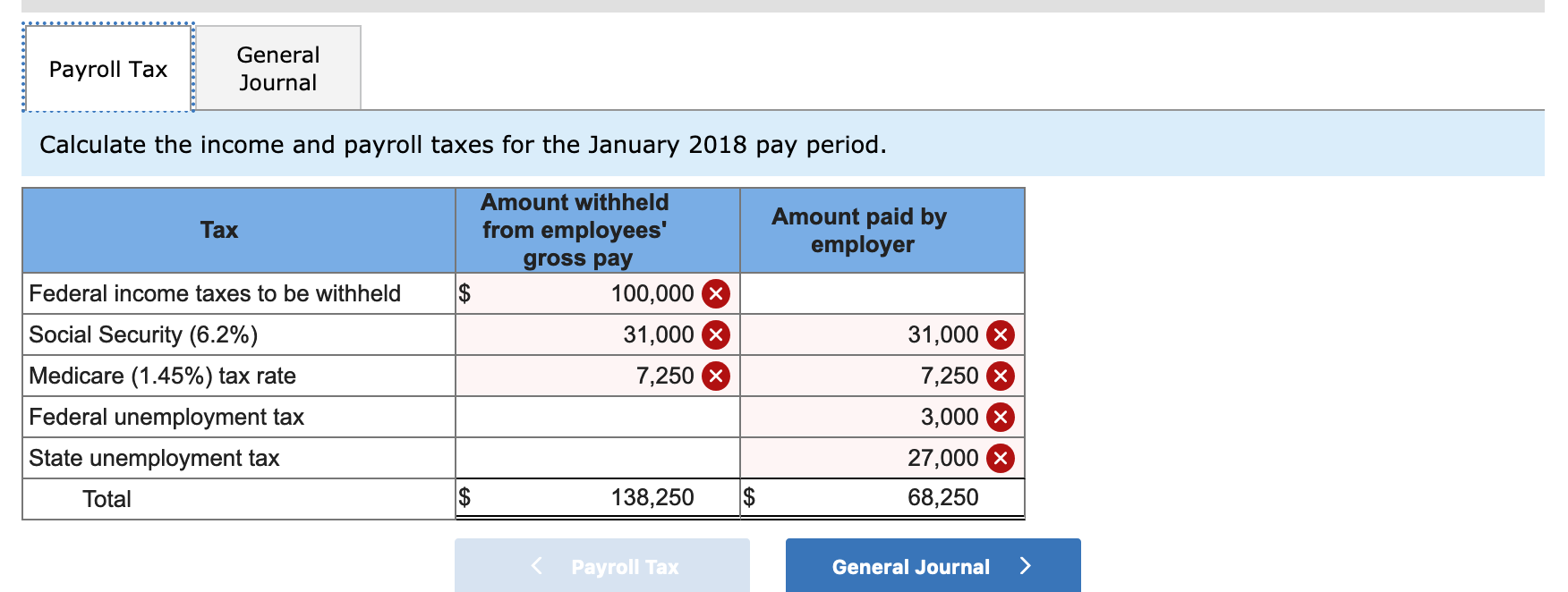

Solved Exercise 13-27 Payroll-related liabilities (Appendix]

Natalia gutierrez of Payroll Simulation - Payroll Simulation Employee 1 Patrick Smith works for a weekly paycheck. He is single and claims no

W4 -Worksheet & Adjusting Entries - The unadjusted trial balance or R. Tryon Consultant is entered on the partial worksheet below. Write the adjusting

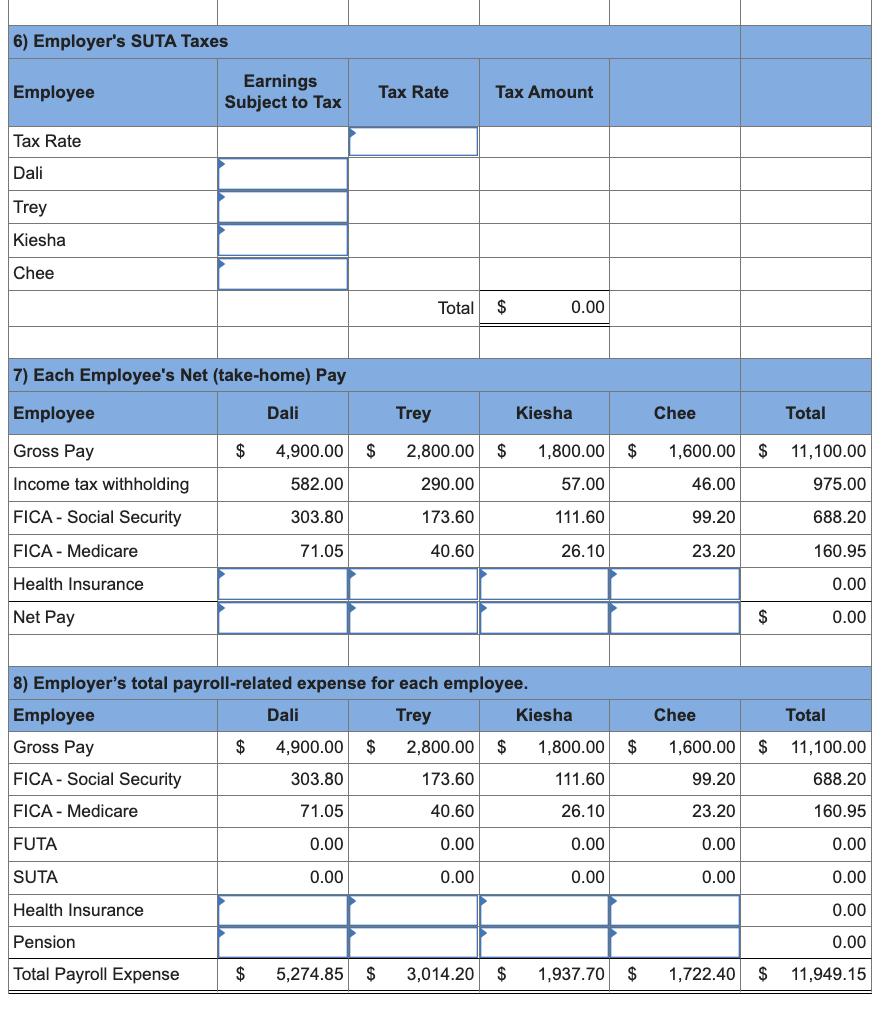

Chapter 7 Payroll Project - Excel Instructions using Excel 2010: CAUTION: Read Appendix B for specific instructio

Solved Problem 9-3A (Algo) Payroll expenses, withholdings

W4 -Worksheet & Adjusting Entries - The unadjusted trial balance or R. Tryon Consultant is entered on the partial worksheet below. Write the adjusting

CPP 5-1 (#2) Calculate and Record Employer Payroll

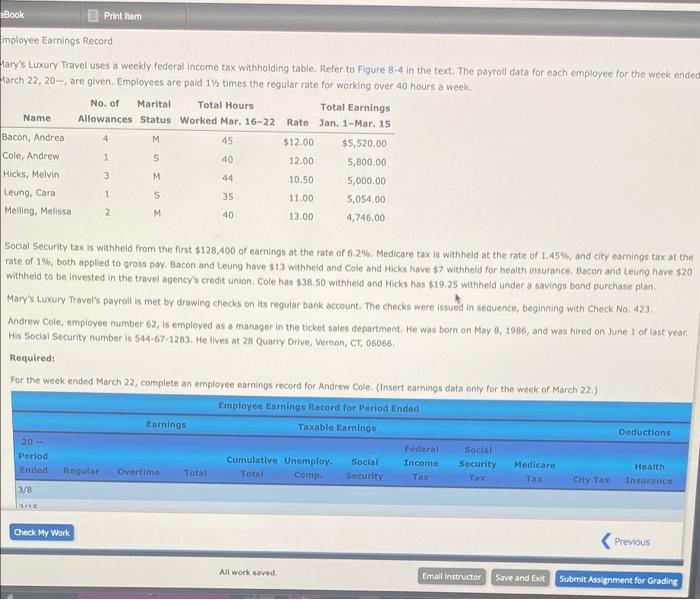

Solved Book Print Iter Employee Earnings Record ary's Luxury

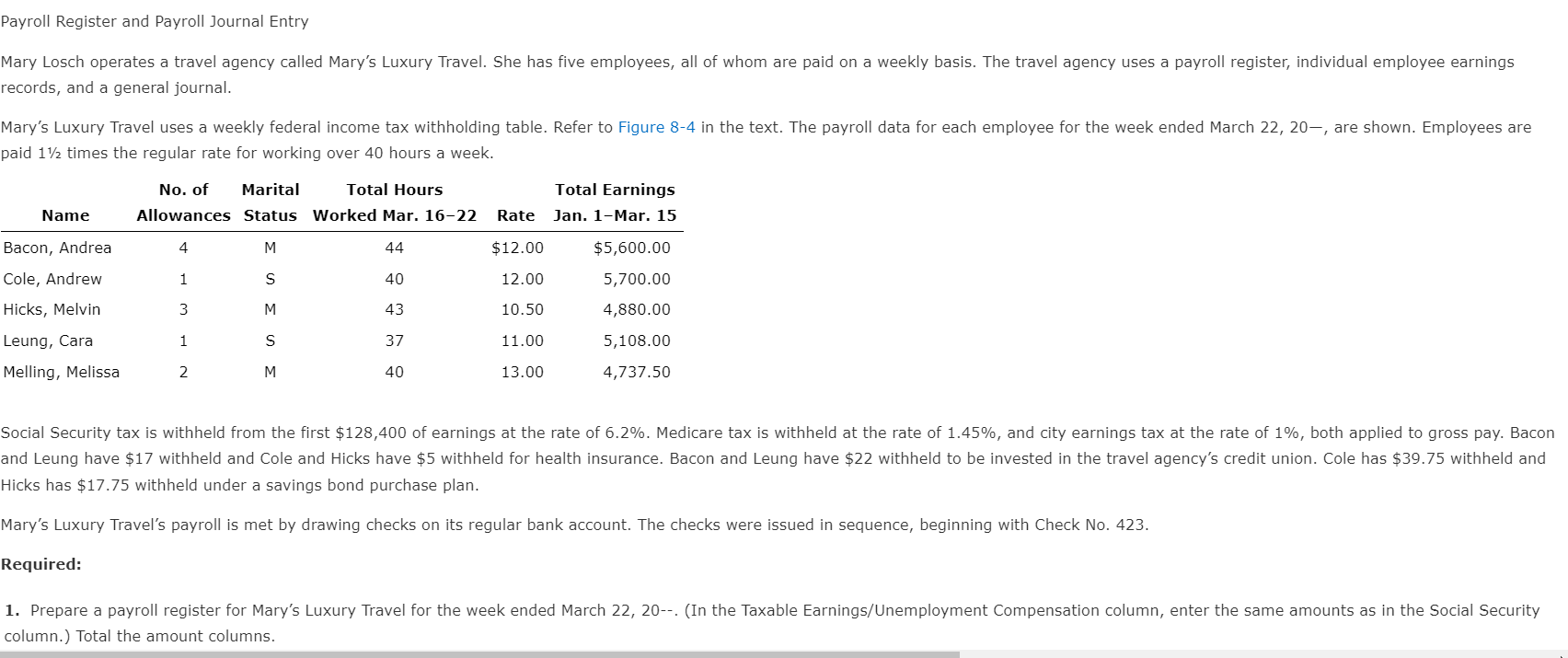

Solved Payroll Register and Payroll Journal Entry Mary Losch

Recomendado para você

-

ROPAY GH APK (Android App) - Free Download12 abril 2025

-

roPay LinkedIn12 abril 2025

-

Rae Ruilin Huang - Ropay12 abril 2025

Rae Ruilin Huang - Ropay12 abril 2025 -

Emmas Ropa Y Mas Inc - Hidalgo, TX 7855712 abril 2025

-

Ropay (ropayyer05) - Profile12 abril 2025

Ropay (ropayyer05) - Profile12 abril 2025 -

Ropay on the App Store12 abril 2025

Ropay on the App Store12 abril 2025 -

Frulatte Repairing Hair Serum enriched with Organic Olive Oil for Dry and Damaged Hair12 abril 2025

Frulatte Repairing Hair Serum enriched with Organic Olive Oil for Dry and Damaged Hair12 abril 2025 -

Chal Dhan Ropay Maithili Song Listen on Music Maithili app@prawaldeepb12 abril 2025

-

Lint Buster - Lint Roller (3 Tape Rolls & 1 Handle) – TEXMACDirect12 abril 2025

Lint Buster - Lint Roller (3 Tape Rolls & 1 Handle) – TEXMACDirect12 abril 2025 -

– Ramp-On – Ramp-Off Payment Gateway12 abril 2025

– Ramp-On – Ramp-Off Payment Gateway12 abril 2025

você pode gostar

-

5 Overwatch 2 aim training routines that will make ranked climb12 abril 2025

5 Overwatch 2 aim training routines that will make ranked climb12 abril 2025 -

5 Formas de Fazer o Eevee Evoluir Para um Espeon ou Umbreon12 abril 2025

5 Formas de Fazer o Eevee Evoluir Para um Espeon ou Umbreon12 abril 2025 -

Legends Bar and Grill12 abril 2025

-

Cristiano Ronaldo marca, e Al Nassr empata com Al-Fateh12 abril 2025

Cristiano Ronaldo marca, e Al Nassr empata com Al-Fateh12 abril 2025 -

Refém do Jogo - Trailer - 22 de novembro nos cinemas12 abril 2025

Refém do Jogo - Trailer - 22 de novembro nos cinemas12 abril 2025 -

BPlayer MOD APK v1.2.1 (Optimized/No ADS) - Jojoy12 abril 2025

-

QUAL É A MÚSICA DO MEME FINO SENHORES?12 abril 2025

QUAL É A MÚSICA DO MEME FINO SENHORES?12 abril 2025 -

RBN Modding12 abril 2025

-

MORØ on X: RT @solywaddle: Indie Cross. FNF Indie Cross Mod directed by: @Moro0986 #fnf #fridaynightfunkin #fnfmod #fnfindiecross #indiecross #boyfr… / X12 abril 2025

-

Hajduk Split Polo Shirt White Macron Hajduk Tr Player Polo Jersey M L XL XXL 3XL12 abril 2025

Hajduk Split Polo Shirt White Macron Hajduk Tr Player Polo Jersey M L XL XXL 3XL12 abril 2025