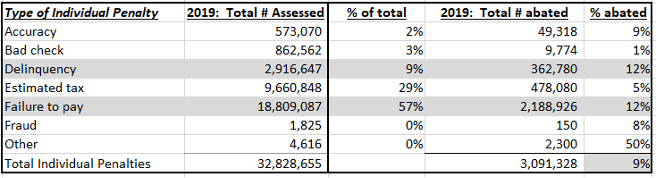

Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

Por um escritor misterioso

Last updated 31 março 2025

:max_bytes(150000):strip_icc()/Term-Definitions_Underpayment-penalty-Resized-7d6a14e797ad4b1584b7f659fff3a568.jpg)

An underpayment penalty is an IRS fee for failing to pay enough of your total tax liability during the year. Here’s how to determine if you owe an underpayment penalty.

What You Need to Know About Underpayment of Tax Penalties

Avoiding Underpayment Penalty: The Consequences of Late Payment - FasterCapital

Do's and Don'ts When Requesting IRS Penalty Abatement - Jackson Hewitt

IRS Penalty and Interest Calculator, 20/20 Tax Resolution

How to Avoid the IRS Underpayment Penalty - Xscapers

:max_bytes(150000):strip_icc()/with-holding-tax-4186749-4d023b8133e443588c8ce795732df79c.jpg)

Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

How to avoid estimated tax penalties - Don't Mess With Taxes

IRS Underpayment Penalties and How to Avoid Them

Strategies for minimizing estimated tax payments

:max_bytes(150000):strip_icc()/Term-Definitions_Underpayment-penalty-Resized-7d6a14e797ad4b1584b7f659fff3a568.jpg)

Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

6 Common IRS Penalties and How to Avoid Them

What Is the IRS Underpayment Penalty?

Recomendado para você

-

Women's World Cup 2023: How does a penalty shootout work?31 março 2025

-

Soccer Penalty Kicks: Rules and Strategies31 março 2025

Soccer Penalty Kicks: Rules and Strategies31 março 2025 -

Handre Pollard's late penalty sends Springboks into RWC final31 março 2025

Handre Pollard's late penalty sends Springboks into RWC final31 março 2025 -

Penalty kicks: What, when, why and other rules31 março 2025

Penalty kicks: What, when, why and other rules31 março 2025 -

World Cup final: How Argentina won penalty shootout31 março 2025

World Cup final: How Argentina won penalty shootout31 março 2025 -

Geir Jordet on X: The penalty shootout in football is the essence31 março 2025

Geir Jordet on X: The penalty shootout in football is the essence31 março 2025 -

Could rule change make penalty shoot-outs fairer? - King's College31 março 2025

Could rule change make penalty shoot-outs fairer? - King's College31 março 2025 -

Megan Rapinoe calls her missed World Cup penalty kick 'a sick joke31 março 2025

Megan Rapinoe calls her missed World Cup penalty kick 'a sick joke31 março 2025 -

Sam Kerr penalty kick, reaction video31 março 2025

-

Final Penalty Kick Clinches 2022 World Cup for Argentina (Video31 março 2025

Final Penalty Kick Clinches 2022 World Cup for Argentina (Video31 março 2025

você pode gostar

-

Adivinhe Quem Toy Card Game, Família Adivinhar Jogo, Jogos de Tabuleiro, Raciocínio Lógico, Pensando, Pensamento Pré-escolar, 96PCs - AliExpress31 março 2025

Adivinhe Quem Toy Card Game, Família Adivinhar Jogo, Jogos de Tabuleiro, Raciocínio Lógico, Pensando, Pensamento Pré-escolar, 96PCs - AliExpress31 março 2025 -

Remote gambling industry calls on European Commission to safeguard notifications31 março 2025

Remote gambling industry calls on European Commission to safeguard notifications31 março 2025 -

Official Android Blog: Google Play Games: capture and share the moment31 março 2025

Official Android Blog: Google Play Games: capture and share the moment31 março 2025 -

Rogue's Pawn: An Adult Fantasy Romance (Covenant of31 março 2025

Rogue's Pawn: An Adult Fantasy Romance (Covenant of31 março 2025 -

Fifa soccer Cut Out Stock Images & Pictures - Page 2 - Alamy31 março 2025

Fifa soccer Cut Out Stock Images & Pictures - Page 2 - Alamy31 março 2025 -

Retroespecial: Earthworm Jim 2 (SNES). Fórum Outer Space - O maior fórum de games do Brasil31 março 2025

Retroespecial: Earthworm Jim 2 (SNES). Fórum Outer Space - O maior fórum de games do Brasil31 março 2025 -

Genoa, Italy. 24 April 2022. Morten Frendrup of Genoa CFC in31 março 2025

Genoa, Italy. 24 April 2022. Morten Frendrup of Genoa CFC in31 março 2025 -

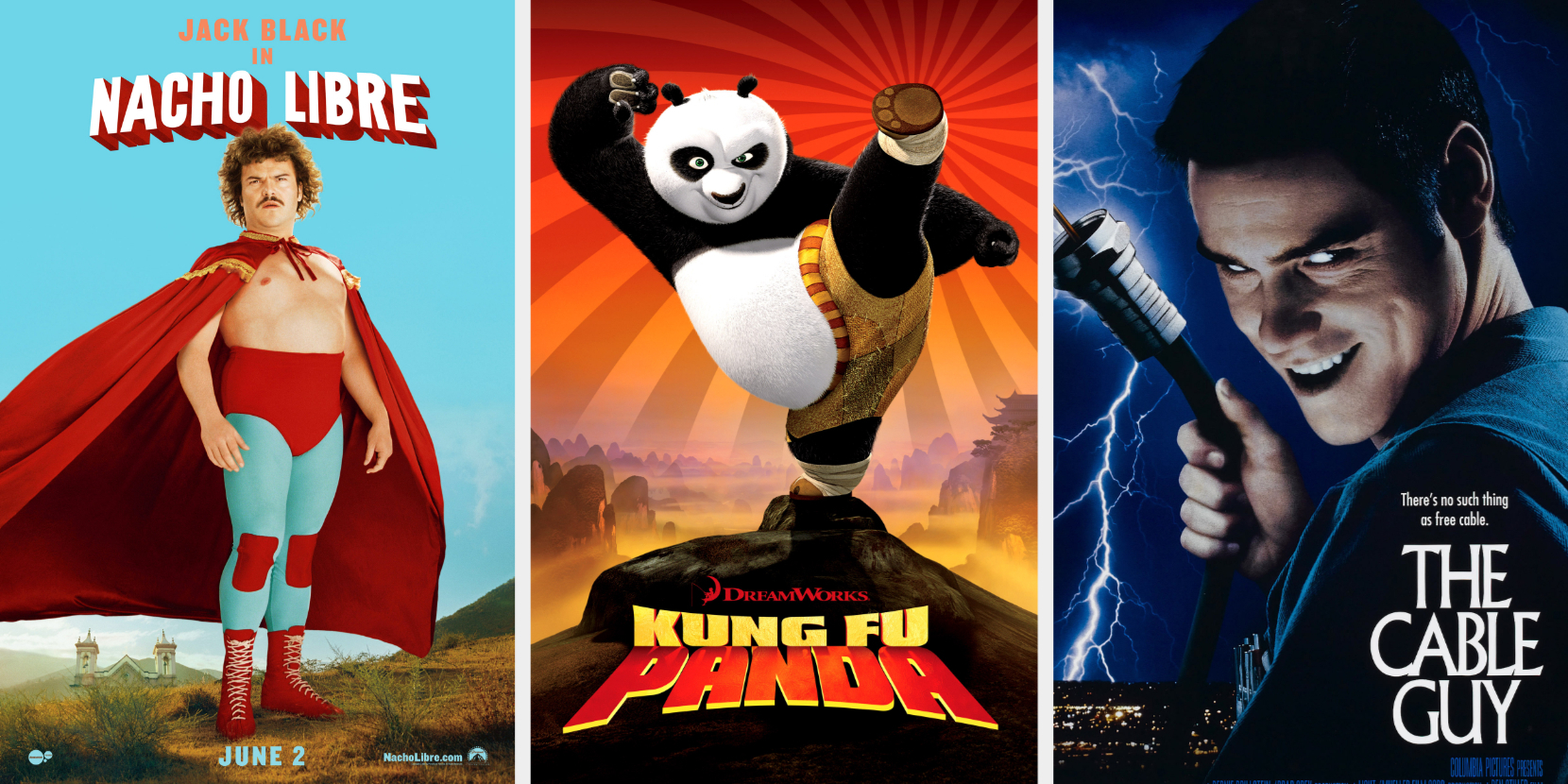

How Many Jack Black Movies Have You Seen?31 março 2025

How Many Jack Black Movies Have You Seen?31 março 2025 -

REVIEW: The Five Nights at Freddy's Movie – Free Press Online31 março 2025

REVIEW: The Five Nights at Freddy's Movie – Free Press Online31 março 2025 -

Chucho Calderón on X: #NuevoPoster La Comic-Con tuvo muchas sorpresas, una de ellas fue el panel crossover de Amphibia y The owl house, donde se reveló el póster, avances y la noticia31 março 2025

Chucho Calderón on X: #NuevoPoster La Comic-Con tuvo muchas sorpresas, una de ellas fue el panel crossover de Amphibia y The owl house, donde se reveló el póster, avances y la noticia31 março 2025