Retrospectively Rated Insurance: What it Means, How it Works

Por um escritor misterioso

Last updated 07 abril 2025

:max_bytes(150000):strip_icc()/Investopedia_RetrospectivelyRatedInsurance_Color-c3ea234ce56245c6b7e9f08983473ced.jpg)

Retrospectively rated insurance is a policy with a premium that adjusts based on the losses experienced by the insured during the current policy period.

:max_bytes(150000):strip_icc()/ExperienceRating-FINAL-871fc36f94cc466da9176c71faa0eec0.png)

Retrospectively Rated Insurance: What it Means, How it Works

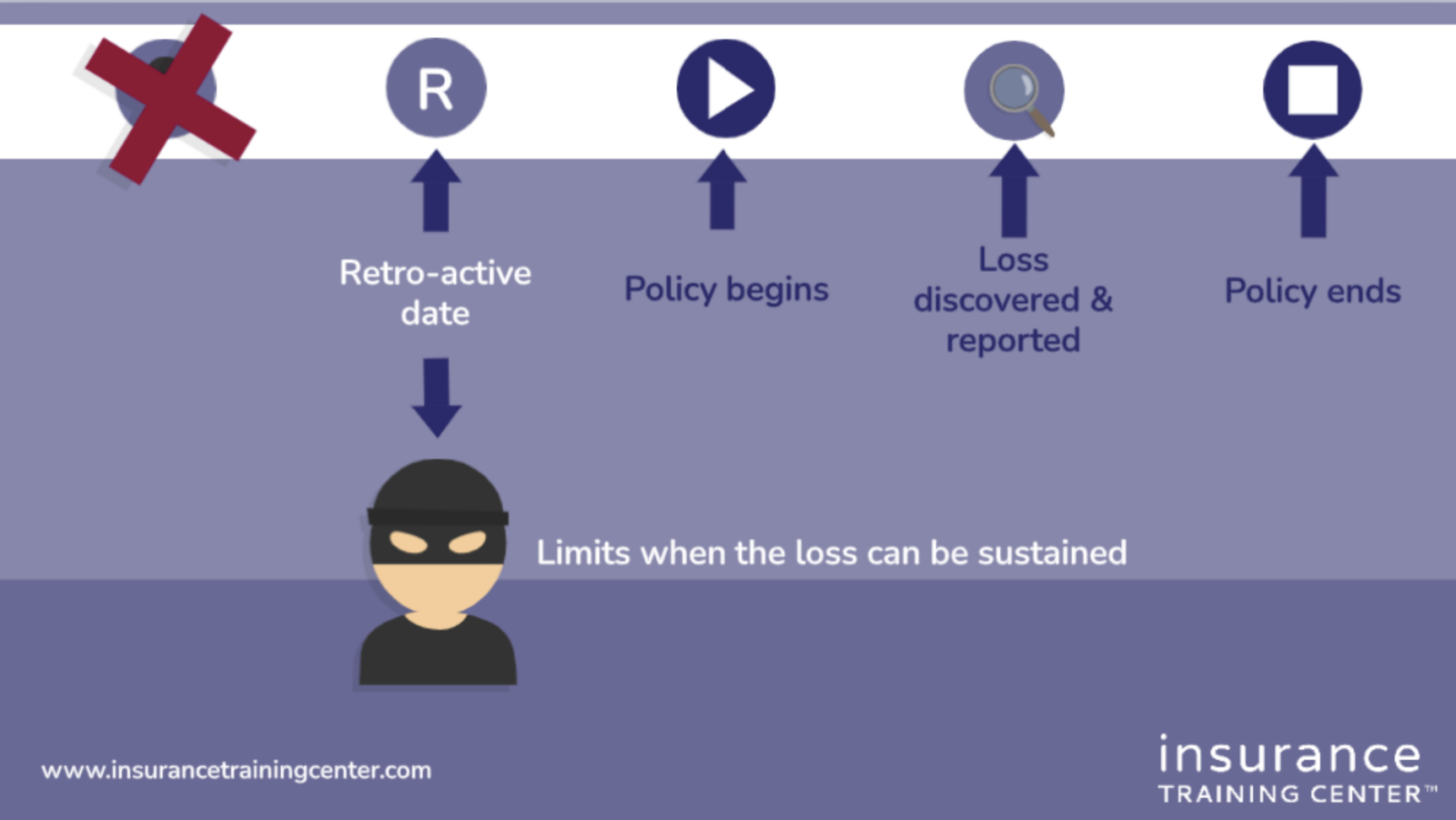

Commercial Crime Insurance - Loss Discovered vs. Loss Sustained - Insurance Training Center

Pharmacy Professional Liability - Pharmacists Mutual Insurance Company

Detailed description of ARM 56 - Insurance Institute of Switzerland

Inside Retrospective Rating Workers' Compensation Plans - Prescient National

Inside Retrospective Rating Workers' Compensation Plans - Prescient National

Medicare Risk Adjustment - RAF Scores

Retrospective Rating Work Comp Insurance Plans

Retrospectively Rated Insurance

The Economic Value of Improved Productivity from Treatment of Chronic Hepatitis C Virus Infection: A Retrospective Analysis of Earnings, Work Loss, and Health Insurance Data

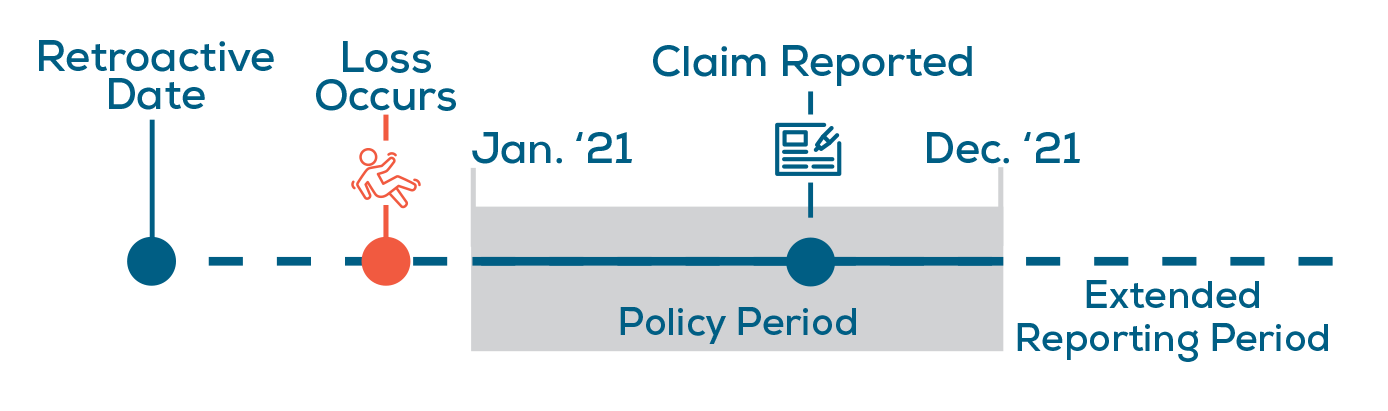

Claims-Made vs. Occurrence Business Insurance: Differences Explained

Recomendado para você

-

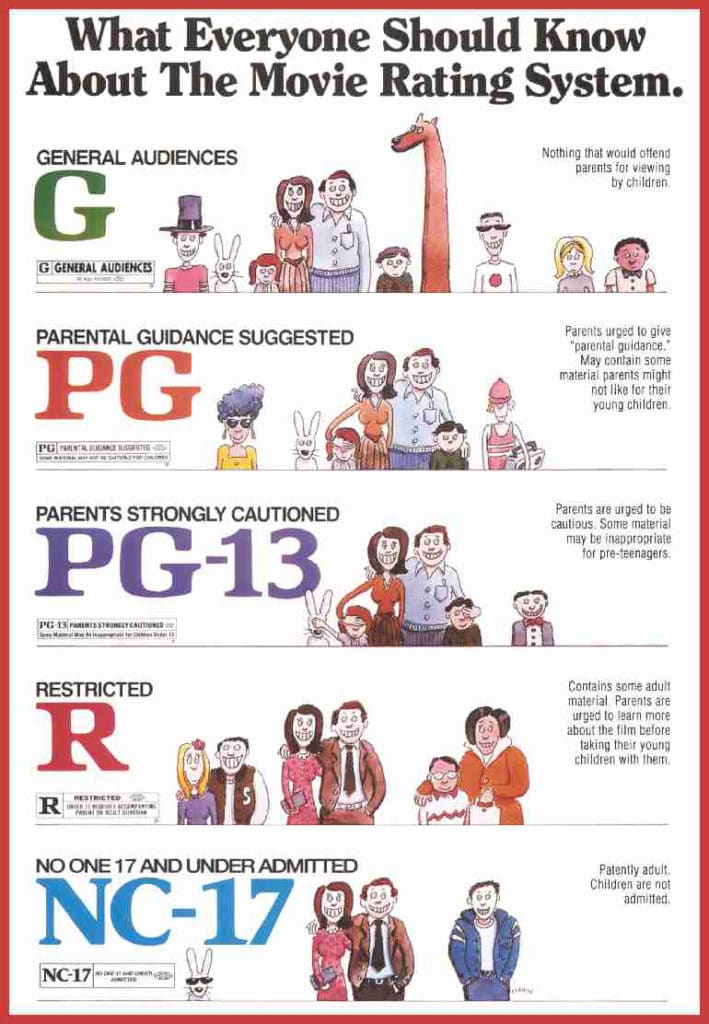

Movie Ratings Explained — Origins & How They've Changed07 abril 2025

Movie Ratings Explained — Origins & How They've Changed07 abril 2025 -

Ratings Info - D'Place Entertainment07 abril 2025

Ratings Info - D'Place Entertainment07 abril 2025 -

Top E rated video games for kids07 abril 2025

Top E rated video games for kids07 abril 2025 -

Ryan Reynolds on X: We're supposed to announce Logan and Deadpool will soon be the first R-rated movies on Disney+. But we all know some Disney movies should already be rated R07 abril 2025

-

Rated R (Red album) - Wikipedia07 abril 2025

Rated R (Red album) - Wikipedia07 abril 2025 -

Irish Film Institute -F-Rating07 abril 2025

Irish Film Institute -F-Rating07 abril 2025 -

Jeep® Trail Rated Badge - Off-Road Vehicle Certification07 abril 2025

Jeep® Trail Rated Badge - Off-Road Vehicle Certification07 abril 2025 -

Ethereum Mainnet Explorer07 abril 2025

Ethereum Mainnet Explorer07 abril 2025 -

Meet the Hot Cast of 'X-Rated: LA,' OUTtv's Steamy New Reality Series07 abril 2025

Meet the Hot Cast of 'X-Rated: LA,' OUTtv's Steamy New Reality Series07 abril 2025 -

Movie Ratings Explained and Why is a Movie Rated PG-13?07 abril 2025

Movie Ratings Explained and Why is a Movie Rated PG-13?07 abril 2025

você pode gostar

-

Chess Gift Karpov Vs Unzicker 1974 Chess Game Print07 abril 2025

Chess Gift Karpov Vs Unzicker 1974 Chess Game Print07 abril 2025 -

Oak Tree Meaning & Symbolism07 abril 2025

Oak Tree Meaning & Symbolism07 abril 2025 -

Steam Community :: 通神榜Noobs Want to Live07 abril 2025

Steam Community :: 通神榜Noobs Want to Live07 abril 2025 -

Subway Surfers io07 abril 2025

Subway Surfers io07 abril 2025 -

Is there a mod that puts this Donte skin on Nero for DMC5? I feel07 abril 2025

Is there a mod that puts this Donte skin on Nero for DMC5? I feel07 abril 2025 -

New and improved: UNLV football clinches bowl with comeback win07 abril 2025

New and improved: UNLV football clinches bowl with comeback win07 abril 2025 -

Assistir Junji Ito: Histórias Macabras do Japão - online07 abril 2025

-

Como desenhar Cacto fofo Kawaii Desenho para desenhar - Drawing07 abril 2025

Como desenhar Cacto fofo Kawaii Desenho para desenhar - Drawing07 abril 2025 -

Xbox 360 Slim Skin - Super Mario - Pop Arte Skins07 abril 2025

Xbox 360 Slim Skin - Super Mario - Pop Arte Skins07 abril 2025 -

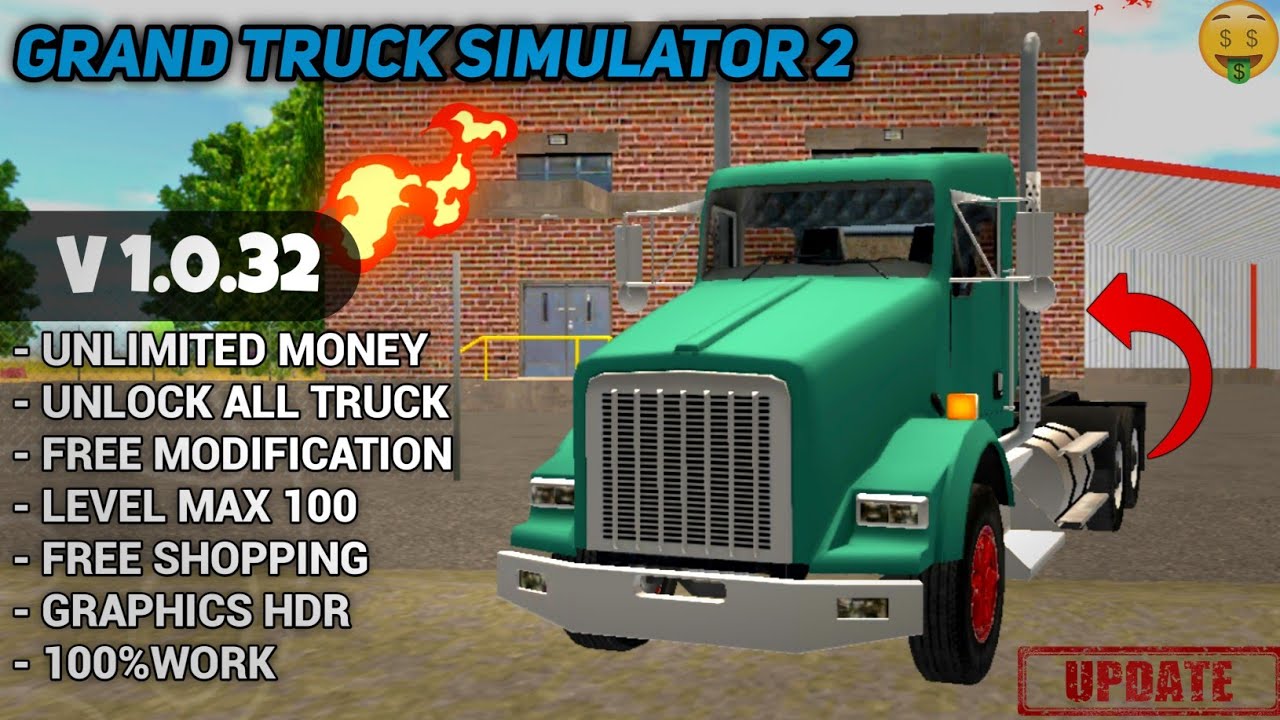

Grand Truck Simulator 2 Version 1.0.32 Unlimited Money07 abril 2025

Grand Truck Simulator 2 Version 1.0.32 Unlimited Money07 abril 2025