Tier 1 Capital: Definition, Components, Ratio, and How It's Used

Por um escritor misterioso

Last updated 10 abril 2025

:max_bytes(150000):strip_icc()/tier1capital.asp_FINAL-9183cdc7ec8b4bd2b230d4ee7af1dec6.png)

Tier 1 capital is used to describe the capital adequacy of a bank and refers to its core capital, including equity capital and disclosed reserves.

Capital adequacy: The Importance of Tier 1 Common Capital Ratio for Banks - FasterCapital

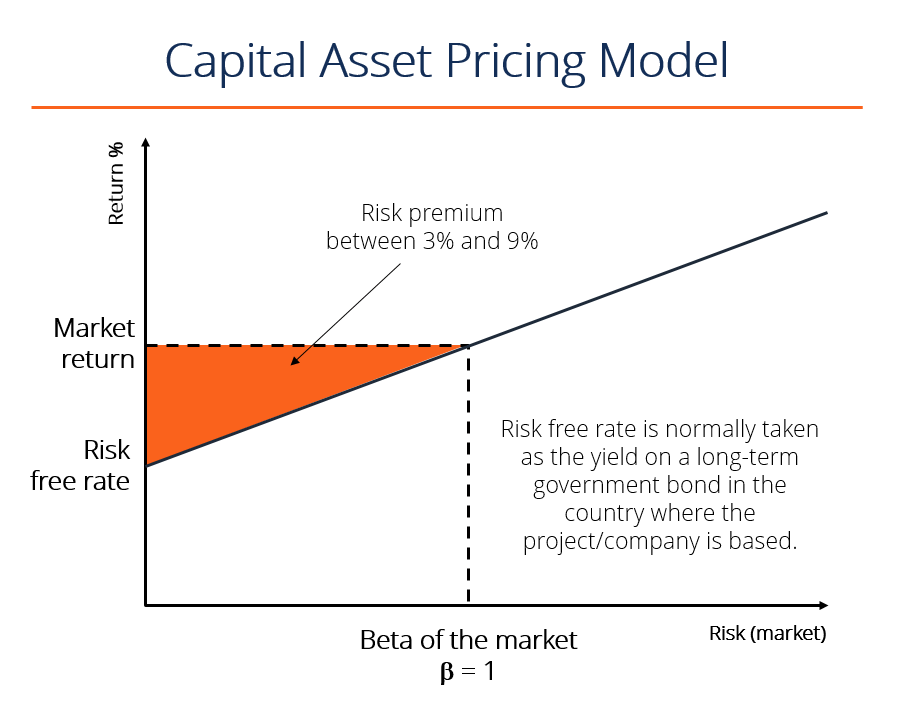

What is CAPM - Capital Asset Pricing Model - Formula, Example

Bank capitalization: Exploring the Tier 1 Common Capital Ratio framework - FasterCapital

Tier 1 Capital Ratio (Definition, Formula)

:max_bytes(150000):strip_icc()/liquidity-coverage-ratio_final_2-fcb28a55d81d4ec8a679dbc8c93a9f24.jpg)

Liquidity Coverage Ratio (LCR): Definition and How To Calculate

What is the Tier 1 Capital Ratio? – SuperfastCPA CPA Review

Gross fixed capital formation - Wikipedia

:max_bytes(150000):strip_icc()/risk-based-capital-requirement_final-8f003e3dbb5e405b9c8e25c8f85dce96.png)

Risk-Based Capital Requirement: Definition, Calculation, Tiers

What the Capital Adequacy Ratio (CAR) Measures, With Formula

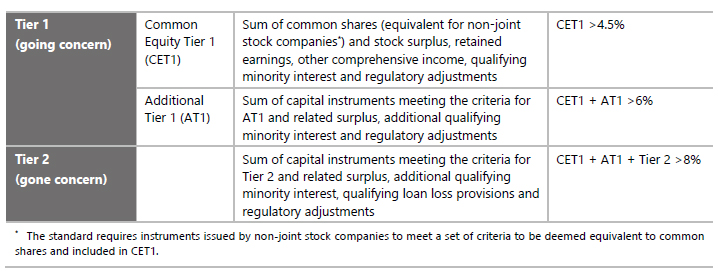

Definition of capital in Basel III - Executive Summary

Basel III regulations: Understanding the Tier 1 Common Capital Ratio - FasterCapital

Recomendado para você

-

Tier ranking10 abril 2025

Tier ranking10 abril 2025 -

Mastering English: Understanding Top-Tier Work10 abril 2025

Mastering English: Understanding Top-Tier Work10 abril 2025 -

Top Tier Life10 abril 2025

-

Tier 1 network - Wikipedia10 abril 2025

Tier 1 network - Wikipedia10 abril 2025 -

Corporate tiering strategies allow schools to focus engagement10 abril 2025

Corporate tiering strategies allow schools to focus engagement10 abril 2025 -

Top Tier Showmen10 abril 2025

-

Tier 1, 2, & 3 Suppliers Difference Explained10 abril 2025

-

Top Tier Bakery10 abril 2025

-

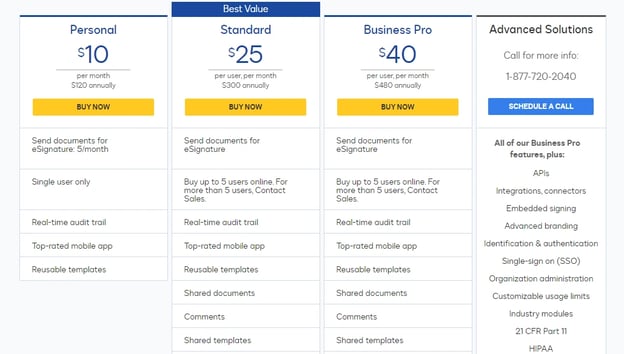

Tiered Pricing: The Complete Guide10 abril 2025

Tiered Pricing: The Complete Guide10 abril 2025 -

My personal Smash Ultimate Tier List10 abril 2025

My personal Smash Ultimate Tier List10 abril 2025

você pode gostar

-

Nanatsu no Taizai: Continuação da série estreia em outubro10 abril 2025

Nanatsu no Taizai: Continuação da série estreia em outubro10 abril 2025 -

Forza Horizon 2 review – Race and explore a vast open world on10 abril 2025

Forza Horizon 2 review – Race and explore a vast open world on10 abril 2025 -

usersenka — RUROUNI KENSHIN (2023) op 「hiten」 by ayase10 abril 2025

usersenka — RUROUNI KENSHIN (2023) op 「hiten」 by ayase10 abril 2025 -

Snakes, facts and information10 abril 2025

Snakes, facts and information10 abril 2025 -

Smash Crashers - Swill Bill10 abril 2025

Smash Crashers - Swill Bill10 abril 2025 -

Sobre Son Goku (Kakaroto) Dragon Ball Super Oficial™ㅤ Amino10 abril 2025

Sobre Son Goku (Kakaroto) Dragon Ball Super Oficial™ㅤ Amino10 abril 2025 -

Universal Studios Hollywood10 abril 2025

-

Volvo FMX 440 5600/CAB Price in India - Mileage, Specs & 2023 Offers10 abril 2025

Volvo FMX 440 5600/CAB Price in India - Mileage, Specs & 2023 Offers10 abril 2025 -

![Complexo Paulista [Explicit] : Vulcaner, Lil Riich, Wega & Guilherme Bastos: Música Digital](https://m.media-amazon.com/images/I/511qlpwMfjL._UXNaN_FMjpg_QL85_.jpg) Complexo Paulista [Explicit] : Vulcaner, Lil Riich, Wega & Guilherme Bastos: Música Digital10 abril 2025

Complexo Paulista [Explicit] : Vulcaner, Lil Riich, Wega & Guilherme Bastos: Música Digital10 abril 2025 -

Tênis: entenda como funciona o ranking mundial e a pontuação de cada torneio10 abril 2025

Tênis: entenda como funciona o ranking mundial e a pontuação de cada torneio10 abril 2025