DoorDash Tax Deductions, Maximize Take Home Income

Por um escritor misterioso

Last updated 19 outubro 2024

This article is the ultimate guide for DoorDash tax deductions. Click to read and learn what DoorDashers can write off.

20+ DoorDash Driver Tips Every Dasher Must Know! (2024) - MoneyPantry

How much can you make on DoorDash without paying taxes? - Quora

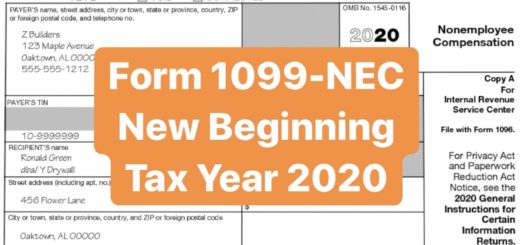

Guide to Doordash 1099 Forms and Dasher Income

8 Strategies For Maximizing Rideshare And Delivery Tax Deductions

Doordash Taxes Made Easy, Ultimate Dasher's Guide, Ageras

Top Dasher Requirements: Learn About DoorDash's Reward Program

Section 280a Deduction: Renting Your Personal Home to Your

How Much Do DoorDash Drivers Make? We Break Down The Numbers

DoorDash Tax Deductions, Maximize Take Home Income

Earn by time is better than most people Ass-U-me, and better for

Deliver with DoorDash? Save $20 on Your Taxes with TurboTax Self

Your tax refund could be smaller than last year. Here's why

DoorDash Rewards Credit Card Review 2023

7 Reasons Why All Gig Workers Need a Mileage Tracking App

Recomendado para você

-

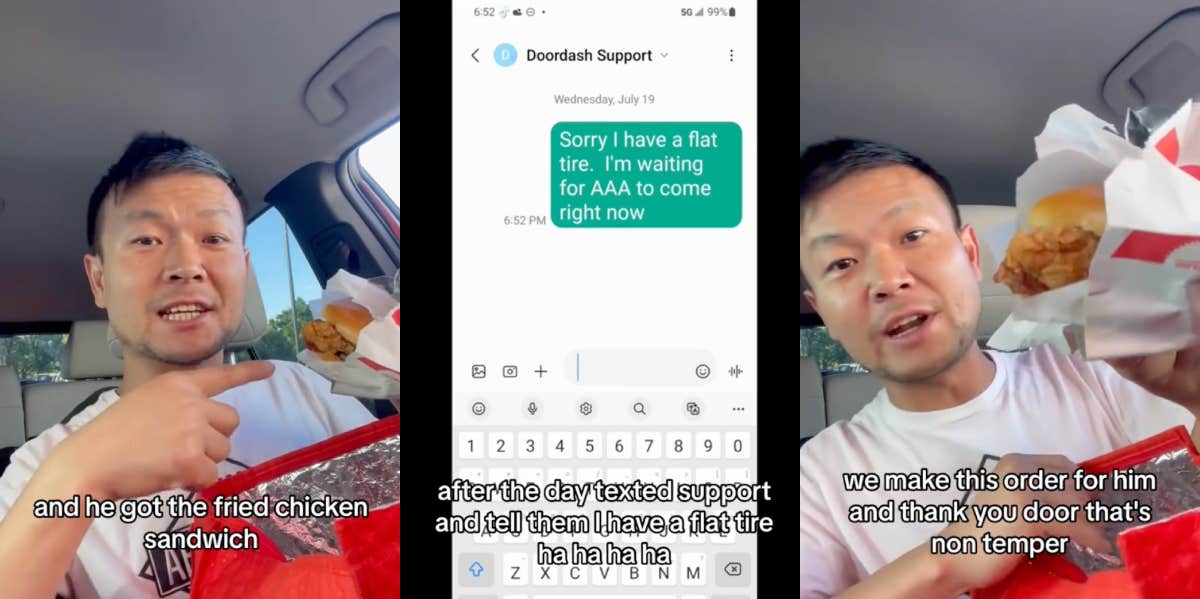

DoorDash Driver Lied About Getting A Flat Tire So He Could Eat A19 outubro 2024

DoorDash Driver Lied About Getting A Flat Tire So He Could Eat A19 outubro 2024 -

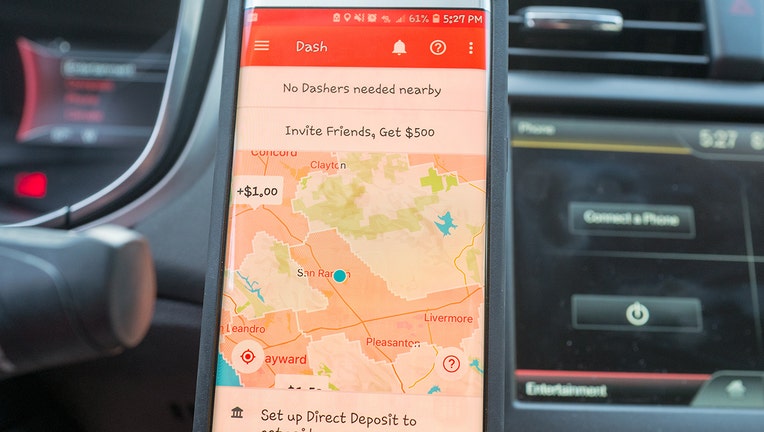

Become a Dasher: Deliver with DoorDash19 outubro 2024

Become a Dasher: Deliver with DoorDash19 outubro 2024 -

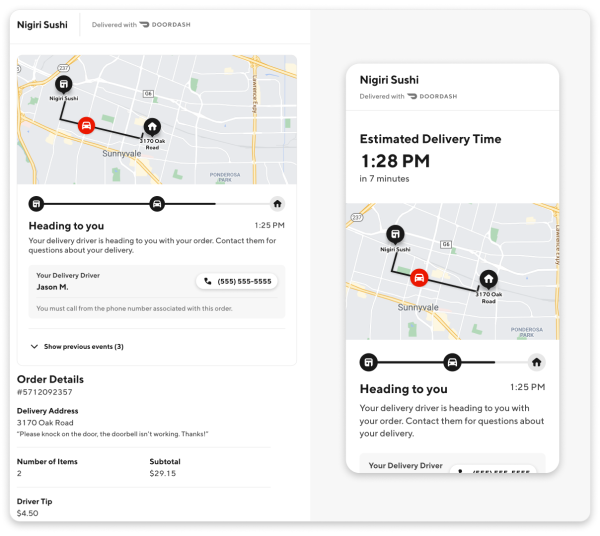

DoorDash Driver Review: How Much Money Can You Make?19 outubro 2024

DoorDash Driver Review: How Much Money Can You Make?19 outubro 2024 -

On-Demand Delivery with DoorDash Drive19 outubro 2024

On-Demand Delivery with DoorDash Drive19 outubro 2024 -

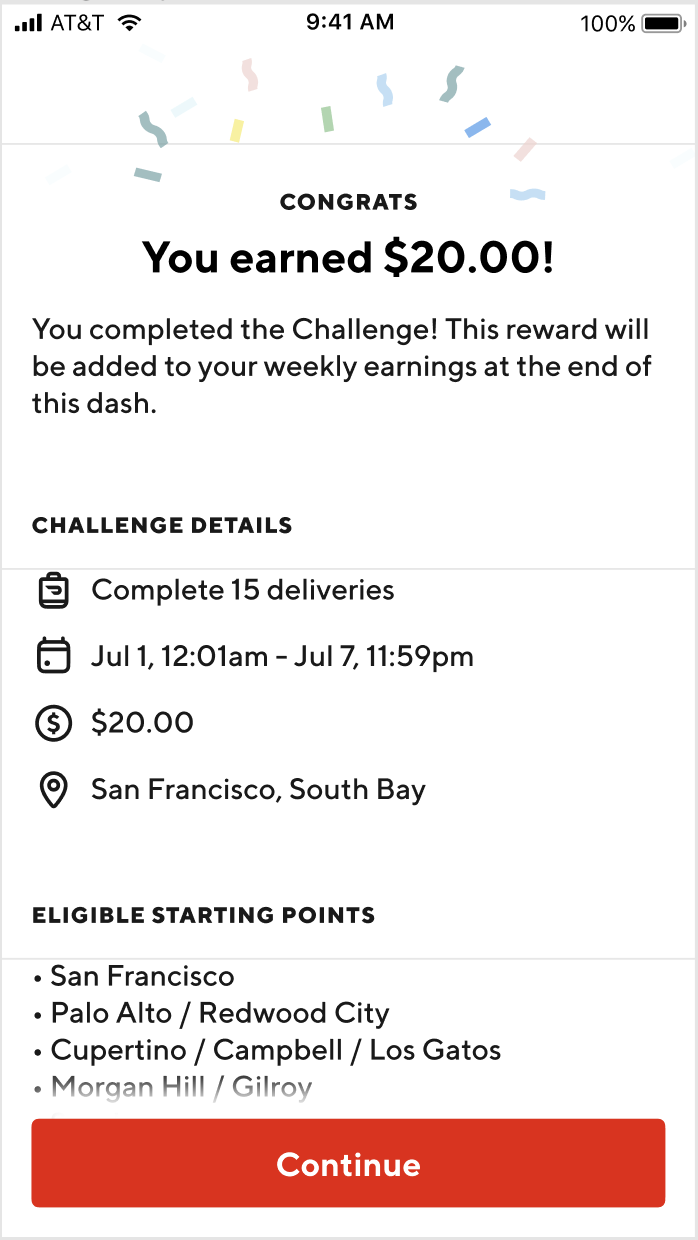

DoorDash unveils hourly pay option for delivery drivers19 outubro 2024

DoorDash unveils hourly pay option for delivery drivers19 outubro 2024 -

DoorDash Driver Review How Much Can You Make in 2023?19 outubro 2024

DoorDash Driver Review How Much Can You Make in 2023?19 outubro 2024 -

DoorDash 101: Getting Started and Making Money as a Dasher19 outubro 2024

DoorDash 101: Getting Started and Making Money as a Dasher19 outubro 2024 -

Seattle mandates higher pay for third-party delivery drivers19 outubro 2024

Seattle mandates higher pay for third-party delivery drivers19 outubro 2024 -

DoorDash couriers struggle to secure COVID sick pay, get back to19 outubro 2024

DoorDash couriers struggle to secure COVID sick pay, get back to19 outubro 2024 -

How Much Can You Earn as a DoorDash Driver in 2022?19 outubro 2024

How Much Can You Earn as a DoorDash Driver in 2022?19 outubro 2024

você pode gostar

-

DOBRADO MILITAR 4 DIAS DE VIAGEM - PARTITURA BANDA MILITAR19 outubro 2024

DOBRADO MILITAR 4 DIAS DE VIAGEM - PARTITURA BANDA MILITAR19 outubro 2024 -

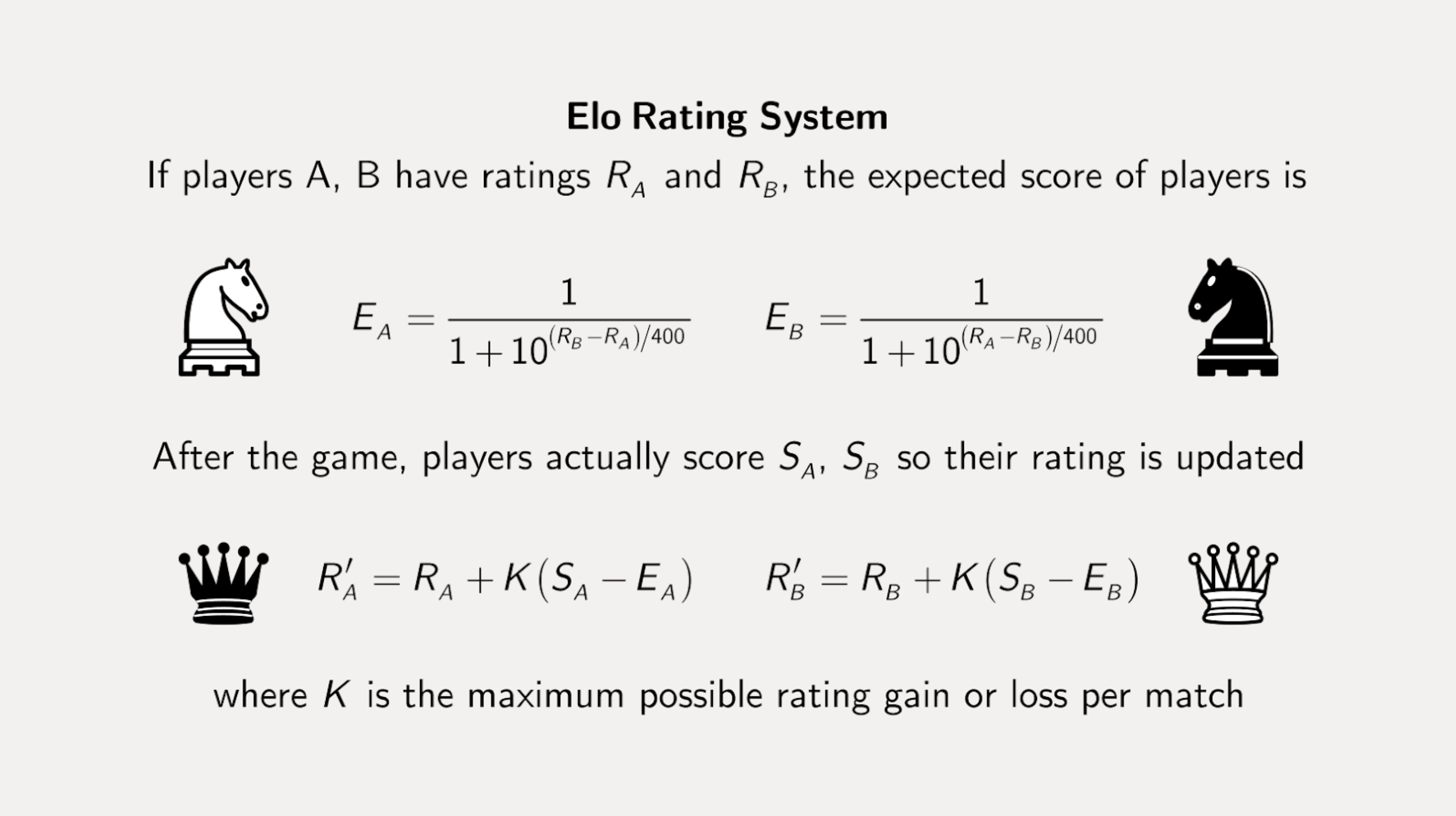

Boost Your Chess Elo with This Secret Hack! — Eightify19 outubro 2024

Boost Your Chess Elo with This Secret Hack! — Eightify19 outubro 2024 -

Goyabu Animes APK - Free download for Android19 outubro 2024

Goyabu Animes APK - Free download for Android19 outubro 2024 -

51 Quotes About Learning Lessons of Life You Have to Remember19 outubro 2024

51 Quotes About Learning Lessons of Life You Have to Remember19 outubro 2024 -

Xbox vs PlayStation: Microsoft takes console war to the cloud by buying Call of Duty makers Activision Blizzard19 outubro 2024

Xbox vs PlayStation: Microsoft takes console war to the cloud by buying Call of Duty makers Activision Blizzard19 outubro 2024 -

ArtStation - Cool anime wallpapers & great for profile pic <319 outubro 2024

ArtStation - Cool anime wallpapers & great for profile pic <319 outubro 2024 -

2021 looks very promising for Xbox (Updated)19 outubro 2024

2021 looks very promising for Xbox (Updated)19 outubro 2024 -

Digimon Ghost Game - Episódio 66 - Animes Online19 outubro 2024

Digimon Ghost Game - Episódio 66 - Animes Online19 outubro 2024 -

Elo, who's the best? - Coorpacademy's Blog19 outubro 2024

Elo, who's the best? - Coorpacademy's Blog19 outubro 2024 -

Como Desenhar o Pikachu: Passo a Passo #shorts19 outubro 2024

Como Desenhar o Pikachu: Passo a Passo #shorts19 outubro 2024