Are Gift Cards Taxable to Employees?

Por um escritor misterioso

Last updated 02 abril 2025

Are gift cards taxable? If your business purchases gift cards for employees, make sure you’re not missing this important reporting step.

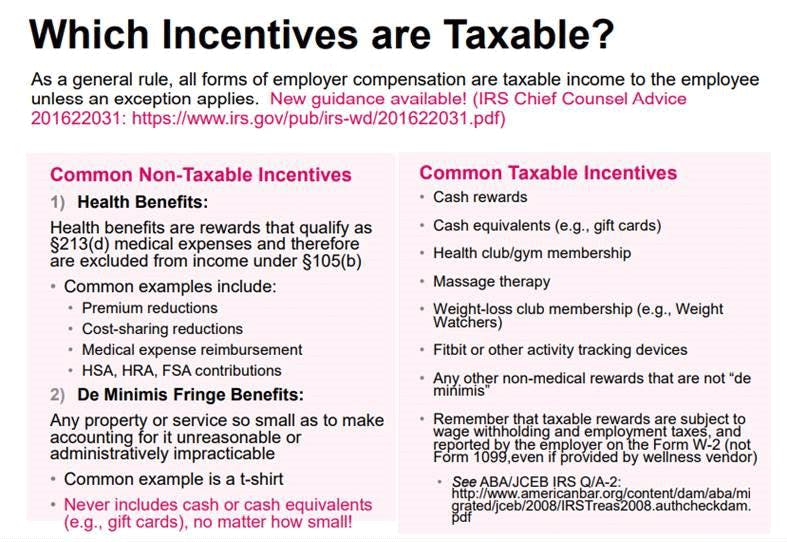

Taxation of Wellness Program Gift Cards

Employee Gifts - Tax Implications of Giving Gifts to Staff, Blog

Employee Gifts: What You Need to Know From a Tax Perspective

The Tax Implications of Employee Gifts - Hourly, Inc.

Are Employee Gifts Taxable? What You Need to Know

Are Gift Cards Taxable Employee Benefit?

Using gift cards as a tax-free trivial benefit

Are gift cards taxable employee benefits?

Are Gifts to Employees Taxable or Deductible?

Employee Based Rewards - Gift Cards: What You Need to Know

Are there any tax issues we need to be aware of when we give employees a gift card or other small gift?

Are Client Gifts Tax Deductable? How to Write off more this year than – Retention Gifts

Q&A: Gift card instead of a cash bonus

Employee Benefits Advisory: Gift cards and other employee incentives are counted as taxable income - MUS Law

Recomendado para você

-

Best Beauty Gifts02 abril 2025

-

Deluxe Favorites Gift Basket, Food Gift Baskets02 abril 2025

Deluxe Favorites Gift Basket, Food Gift Baskets02 abril 2025 -

Birthday Gift Ideas: To Make Special Occasion Unforgettable.02 abril 2025

Birthday Gift Ideas: To Make Special Occasion Unforgettable.02 abril 2025 -

Gift Box Images Free HD Backgrounds, PNGs, Vectors & Templates - rawpixel02 abril 2025

Gift Box Images Free HD Backgrounds, PNGs, Vectors & Templates - rawpixel02 abril 2025 -

The Best Holiday Gift Idea02 abril 2025

The Best Holiday Gift Idea02 abril 2025 -

Gift Ideas02 abril 2025

Gift Ideas02 abril 2025 -

How to buy gifts on a budget : Life Kit : NPR02 abril 2025

How to buy gifts on a budget : Life Kit : NPR02 abril 2025 -

69 Best Subscription Boxes to Gift 202302 abril 2025

69 Best Subscription Boxes to Gift 202302 abril 2025 -

The Ethics of Workplace Gift Giving - Insperity02 abril 2025

The Ethics of Workplace Gift Giving - Insperity02 abril 2025 -

Find amazing Secret Santa or white elephant gifts under $30 on02 abril 2025

Find amazing Secret Santa or white elephant gifts under $30 on02 abril 2025

você pode gostar

-

Oshi - Lost in Anime02 abril 2025

Oshi - Lost in Anime02 abril 2025 -

COMO GANHAR GCUBES de GRAÇA e INFINITOS no BED WARS do BLOCKMAN GO !!02 abril 2025

COMO GANHAR GCUBES de GRAÇA e INFINITOS no BED WARS do BLOCKMAN GO !!02 abril 2025 -

THE BEST 10 Pizza Places near Vila Merces, Vila Merces - SP02 abril 2025

THE BEST 10 Pizza Places near Vila Merces, Vila Merces - SP02 abril 2025 -

Military Tycoon codes (December 2023) — free rewards and credits02 abril 2025

Military Tycoon codes (December 2023) — free rewards and credits02 abril 2025 -

Novo monstrinho faz sua estreia no jogo Pokémon Go; confira qual é02 abril 2025

Novo monstrinho faz sua estreia no jogo Pokémon Go; confira qual é02 abril 2025 -

Category:Help Wanted, Triple A Fazbear Wiki02 abril 2025

Category:Help Wanted, Triple A Fazbear Wiki02 abril 2025 -

Bringing editing into the modern era: A revitalized experience for all02 abril 2025

Bringing editing into the modern era: A revitalized experience for all02 abril 2025 -

hahah i just finish my haha funny r63 and i felt regret for it (you know my avatar is a girl)02 abril 2025

-

Boneco Action Goku Sayajin Dragonball Z 18Cm - Casa & Vídeo02 abril 2025

Boneco Action Goku Sayajin Dragonball Z 18Cm - Casa & Vídeo02 abril 2025 -

FIFA 22 - The Play List02 abril 2025

FIFA 22 - The Play List02 abril 2025