Publication 970 (2022), Tax Benefits for Education

Por um escritor misterioso

Last updated 02 abril 2025

Publication 970 - Introductory Material Future Developments What's New Reminders

Maximizing the higher education tax credits - Journal of Accountancy

About Publication 970, Tax Benefits for Education

Is College Tuition Tax-Deductible?

About Publication 970, Tax Benefits for Education

What Are IRS Publications? - TurboTax Tax Tips & Videos

:max_bytes(150000):strip_icc()/taxsmart-ways-help-your-kidsgrandkids-pay-college.aspv2-ca33db2b45af47d2bcd23ca1a70304df.jpg)

Tax-Smart Ways to Help Your Kids or Grandkids Pay for College

Teacher Expense Income Tax Deduction Raised to $300 - CPA Practice Advisor

Publication 970 (2022), Tax Benefits for Education

Tax Information Seattle Pacific University

Publication 970 (2022), Tax Benefits For Education Internal, 60% OFF

How to Pay for College for a Grandchild or Someone Else, Grandparents Paying for College

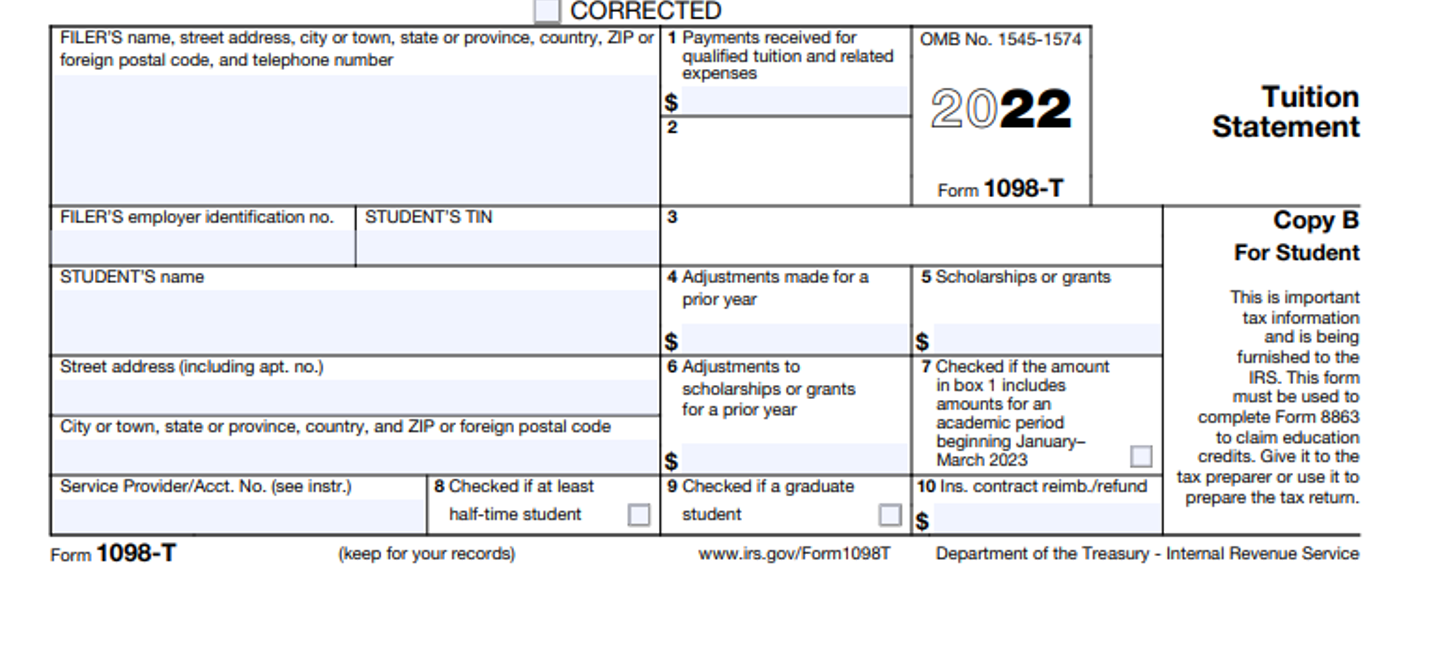

IRS Form 1098-T, Enrollment Services (RaiderConnect)

The 2 Education Tax Credits for Your Taxes

How to Interpret the 1098-T

Maximizing the tax benefits of 529 plans

Recomendado para você

-

Pin on rol02 abril 2025

Pin on rol02 abril 2025 -

Five Star Spiral Notebooks + Study App, 3 Pack, 1 Subject, College Ruled Paper, Pockets, 100 Sheets, Home School Supplies for College Student or K-1202 abril 2025

Five Star Spiral Notebooks + Study App, 3 Pack, 1 Subject, College Ruled Paper, Pockets, 100 Sheets, Home School Supplies for College Student or K-1202 abril 2025 -

March of the Mini Beasts (1) (The DATA Set) by Hopper, Ada02 abril 2025

March of the Mini Beasts (1) (The DATA Set) by Hopper, Ada02 abril 2025 -

The Truth about Bats (The Magic School Bus by Moore, Eva02 abril 2025

The Truth about Bats (The Magic School Bus by Moore, Eva02 abril 2025 -

New in School Chapter 1 Page 13 – Albert The Alien02 abril 2025

New in School Chapter 1 Page 13 – Albert The Alien02 abril 2025 -

Tampa Bay – Tampa Bay NFL Alumni02 abril 2025

Tampa Bay – Tampa Bay NFL Alumni02 abril 2025 -

Go Math 5th Grade Math Review Chapter 1 Place Value02 abril 2025

-

NCERT Solution for Class 11 Accountancy Chapter 1 Introduction to Accounting Download Free PDF02 abril 2025

NCERT Solution for Class 11 Accountancy Chapter 1 Introduction to Accounting Download Free PDF02 abril 2025 -

Journey To Empowerment: Tackling the Bullies Within: 9781909389243: Hinds, Jacqueline A: Books02 abril 2025

Journey To Empowerment: Tackling the Bullies Within: 9781909389243: Hinds, Jacqueline A: Books02 abril 2025 -

21 Engaging Back to School Chapter Books02 abril 2025

21 Engaging Back to School Chapter Books02 abril 2025

você pode gostar

-

Baixe o GifCam - GIF Maker-Editor MOD APK v Vídeo para GIF Animado02 abril 2025

Baixe o GifCam - GIF Maker-Editor MOD APK v Vídeo para GIF Animado02 abril 2025 -

Was exploring level 11 and found this building. : r/backrooms02 abril 2025

Was exploring level 11 and found this building. : r/backrooms02 abril 2025 -

É comum menstruar duas vezes no mês!02 abril 2025

É comum menstruar duas vezes no mês!02 abril 2025 -

O que é um domain hack? Aprenda a fazer hack de um domínio.02 abril 2025

O que é um domain hack? Aprenda a fazer hack de um domínio.02 abril 2025 -

cheap used computer store Electronics Repair And Technology News02 abril 2025

cheap used computer store Electronics Repair And Technology News02 abril 2025 -

Steam deixará você comprar trilhas sonoras sem precisar ser dono02 abril 2025

Steam deixará você comprar trilhas sonoras sem precisar ser dono02 abril 2025 -

minato vs tobi - Desenho de boruto_uzumakl123 - Gartic02 abril 2025

minato vs tobi - Desenho de boruto_uzumakl123 - Gartic02 abril 2025 -

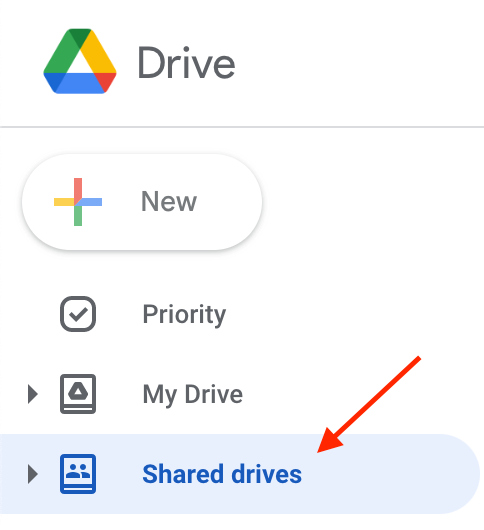

Google Shared Drive – IT Connect02 abril 2025

Google Shared Drive – IT Connect02 abril 2025 -

🏍️🚀 Esse jogo no celular tá Foda #gtamotovlog #gtamobile #gtaandr02 abril 2025

-

Anime-Style Religious Icons Cause Stir in Russian Region - The02 abril 2025

Anime-Style Religious Icons Cause Stir in Russian Region - The02 abril 2025